Three Key Things to Know at the Start:

- With escalating geopolitical tensions, corporations are sourcing alternative suppliers from other countries.

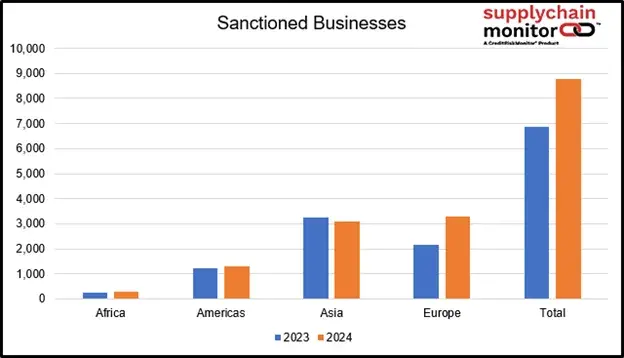

- Sanctioned companies increased by 52% year-over-year, with China and Russia representing the bulk of new sanctions.

- Procurement professionals should always seek alternative vendors for their high-dollar spend and critical supply categories, and especially so for China-based suppliers.

Global sanctions have rapidly expanded against Russia and China. Taiwan, South Korea, and Japan have recently imposed additional sanctions to curb exports to Russia. China also reiterated its interest in reunifying with Taiwan, a concern for global semiconductor trade. And, in 2024, the Netherlands partially revoked ASML’s export license to sell certain advanced microprocessors to China. With escalating geopolitical tensions, corporations are sourcing alternative suppliers from other countries.

The New Sanction Scare

SupplyChainMonitor™ tracks sanctions imposed on companies through international and regional regulatory bodies worldwide, including organizations tied to the U.S., U.K., U.N., E.U., Canada, Australia, and Japan. Supply chains must address such compliance risks as sanctions can unexpectedly and forcefully terminate business relationships.

Sanctioned businesses tracked by SupplyChainMonitor mostly exist in China and Russia. Sanctioned companies increased by 52% year-over-year, with China and Russia representing the bulk of new sanctions.

SupplyChainMonitor captures sanctions applicable to named entities and enriches this list with its parent-subsidiary relationships data. Subscribers can quickly identify all related entities, which can range from several related entities up to hundreds of unique subsidiaries and business names.

Many countries have curbed trade with Russia, yet China still represents a significant portion of global exports. However, China’s total exports have been flat for more than two consecutive years. That lack of growth has been driven by a combination of China Plus One, onshoring, nearshoring, and friendshoring sourcing strategies.

CreditRiskMonitor highlighted the trade beyond China shift in early 2023. This trend is now in full swing with companies making significant adjustments: “Companies are targeting a roughly 40% reduction in China exposure; deep analysis is now devoted to “make vs. buy” strategies and global procurement cost modeling is increasingly employed. This is further necessitated by the fact China, in many cases, is no longer the total landed cost leader, especially when adjusted for risk,” according to research by AlixPartners.

Sourcing Beyond China

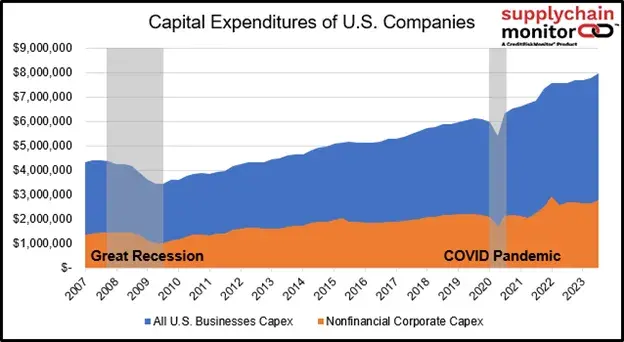

U.S. businesses are investing in supply chains domestically and abroad. Since 2019, U.S. companies have collectively increased capital expenditures incrementally by nearly $2 trillion; $500 billion of which came from nonfinancial corporations. All companies are targeting investments in countries with lower risk profiles and/or reliable suppliers with geographic diversity.

SupplyChainMonitor enables procurement professionals to strategically source from more than 30 million vendors to increase opportunity while mitigating risk. SupplyChainMonitor maps supplier locations globally so procurement professionals can gain better insight into their suppliers’ factories, warehouses, etc. SupplyChainMonitor also provides country risk ratings, risk categories, and research sourced through the Economist Intelligence Unit (EIU). This solution enables subscribers to evaluate country risks from a macro perspective and by supplier location.

A prominent example was Apple Inc.’s decision to diversify a quarter of its manufacturing production to India. One of Apple’s battery manufacturers, Japan-based TDK Corporation has planned to build a plant in India for Apple’s iPhones, according to Reuters. As it turns out, TDK is a reliable supplier.

Access SupplyChainMonitor Reports

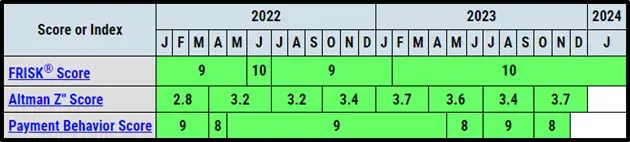

Subscribers can perform deep company research while using SupplyChainMonitor. First, procurement professionals should establish whether the supplier is financially sound. In this case, TDK demonstrates strong financial health with its FRISK® score of “10,” based on the "1" (highest risk)-to-"10" (lowest risk) bankruptcy risk scale:

TDK ranks in the best group of FRISK® scored companies in the SIC classification No. 36 (Electronic and other electrical equipment and components, except computer). TDK’s report also contains the following summarized information:

- Financial risk scores and credit ratings indicate strong financial health

- India’s country risk ratings indicate lower risk relative to China

- Diverse business locations worldwide

- Payments to Tier 2 suppliers are consistently prompt

- Material questions to ask about this supplier indicate positive and strong trends

- Peer analysis rankings trend in the median or top quartile of industry competitors

- Not listed on any sanctions program

Apple's strategy to shift some production from China to India under a financially-sound, geographically-diverse battery manufacturer positions it well for the future.

Companies that follow Apple’s lead can eliminate the risk of supply disruptions and improve on cost.

Bottom Line

The shift away from China’s manufacturing hub is expected to transpire for years, as companies find new suppliers and build out new manufacturing capacity. Companies that solely rely on China to supply their goods may eventually be faced with sanctions, trade restrictions – even embargos. Procurement professionals should always seek alternative vendors for their high-dollar spend and critical supply categories, and especially so for China-based suppliers.

To learn more about category risks impacting supply chains, see how SupplyChainMonitor™ provides clients with actionable guidance.