Automotive manufacturers and suppliers are navigating a complex landscape – balancing new manufacturing, sourcing strategy, and bankruptcy. Recently, the Consumer Federation of America’s “Driven to Default” report underscored three concerning consumer finance trends in the auto market:

- Household budgets are strained by large auto loans and monthly payments

- 20% of consumers now have 7-year car loans, with 8-year terms returning

- Auto loan default rates and repossessions are approaching a 15-year high

Fitch Ratings – reported by The Wall Street Journal – shows subprime auto loans 60+ days overdue have reached 6%, the highest delinquency rate on record. This trend is concerning since consumers prioritize auto payments for transportation to work. Will these trends broadly impact the automotive industry? It seems likely.

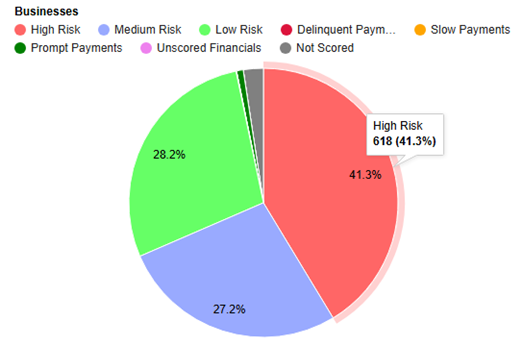

Currently, about 41% of U.S. automotive industry – including manufacturers, parts suppliers, and dealers – are demonstrating High Risk. For context, Risk Level provides a unified financial risk indicator by mapping the most reliable model analytic available for the company. Financial distress is clear in the private market, where 4 private companies recently filed for bankruptcy protection: Tricolor Auto Group, First Brands Group, Preston Cycles LLC, and Threepieceus LLC.

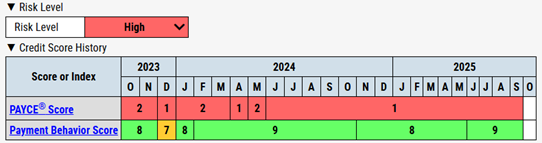

| Company | Risk Level | PAYCE® Score | Bankruptcy Date |

| Tricolor Auto Group, LLC | High | 2 | 09/10/2025 |

| First Brands Group, LLC | High | 1 | 09/28/2025 |

| Threepieceus, LLC | High | 2 | 10/01/2025 |

| Preston Cycles LLC | High | 1 | 10/06/2025 |

Mapping Supplier Financial Risk Exposure

Sourcing and procurement professionals use SupplyChainMonitor™ to map their suppliers, spend, and understand risk exposure. Our financial risk analytics enable clients to stay ahead of supplier bankruptcy, disruptions, and financial loss. Across the automotive industry, SupplyChainMonitor™ identifies 600+ U.S. companies as High Risk.

This High Risk group is comprised of companies with above average risk of bankruptcy or delinquency across our proprietary financial risk analytics, including our 96%-accurate FRISK® Score and 80%-accurate PAYCE® Score.

High Risk Automotive Situations

HP Pelzer Automotive Systems, Inc. (a U.S. subsidiary of Adler Plastic SpA) is another “High” Risk Level automotive company based on its PAYCE® Score of “1”, the worst score on the bankruptcy scale. SupplyChainMonitor™ shows this parent company is another multi-billion dollar automotive company, currently rated “B-” by Fitch Ratings. Financial distress at both the parent and subsidiary level is a red flag.

Novelis, Inc., a major supplier of hot mill aluminum to the automotive industry, experienced a plant fire at its Oswego Facility and ceased operations in September. SupplyChainMonitor™ immediately alerted clients about the fire and that there was no operational restart date. Later, Novelis indicated that operations should resume sometime in early Q1 2026, which indicates over 3 months of supply downtime.

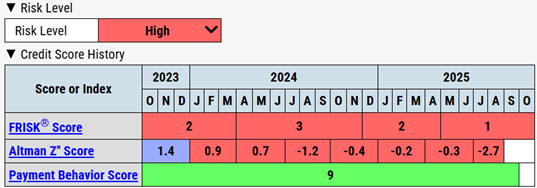

Superior Industries International, among the riskiest public companies in automotive, acts as a key Tier 1 supplier within the OEM supply chain. Superior Industries manufactures lightweight aluminum wheels used in vehicle assembly for major global automakers, including General Motors, Ford, and Stellantis. Superior delivers finished, OEM-specified components directly to production lines, integrating closely with automakers’ design, engineering, and just-in-time manufacturing systems. Superior Industries International’s “High” Risk Level is based on its FRISK® Score of “1”.

Superior has experienced severe financial challenges, including having to request covenant waivers and has indicated it may be unable to satisfy its commitments, according to its Q2 2025 MD&A:

“While we have obtained a waiver related to our financial covenants under our Credit Agreements for the test period ended June 30, 2025, we do not expect that we will be able to meet our financial covenants as early as September 30, 2025.”

Staying Ahead of Supplier Challenges

For both the bankrupt automotive companies and high-risk situations listed above, supply professionals access our financial risk analytics, enhanced news alerts, and reporting to guide supplier monitoring, onboarding, and contingency planning. Clients implement approaches based on their unique situations, including:

- Engaging directly with the supplier

- Initiating contingency or dual-sourcing strategies,

- Renegotiating contract terms or financing, and

- Adjusting inventory and order planning based on risk exposure.

These tactics mitigate disruptions caused by adverse events, financial distress, and bankruptcy.

Bottom Line

Developments in the automotive industry are critical to understanding how vendor bankruptcies, and looming risks like HP Pelzer Automotive Systems and Superior Industries International, impact supply chains. You never know where risks may emerge, so it’s essential to have the most timely and accurate tools available to anticipate potential disruptions. Moreover, when those risks materialize, you need to quickly assess the impact on your counterparties. See how you can implement this approach to your own supply chain.