China’s non-financial corporate debt remains the highest of any industrialized nation at $27 trillion, or 152% of GDP, considerably larger than any other economy worldwide. Throughout 2021 and 2022, CreditRiskMonitor chronicled the scale and depth of this ongoing Chinese debt crisis. On Aug. 15, the People’s Bank of China (PBOC) reactively cut its loan prime rate and medium-term lending facility rate to support credit demand.

Chinese property developers are at the center of the storm. In fact, the top 100 Chinese property developers reported July sales declined by 39.7% year-over-year, according to The Wall Street Journal. While Chinese property developer defaults have become the norm, formal bankruptcies have started to take shape in 2022, and industry giant China Evergrande Group may be among the next to file.

Fallen Property Developers

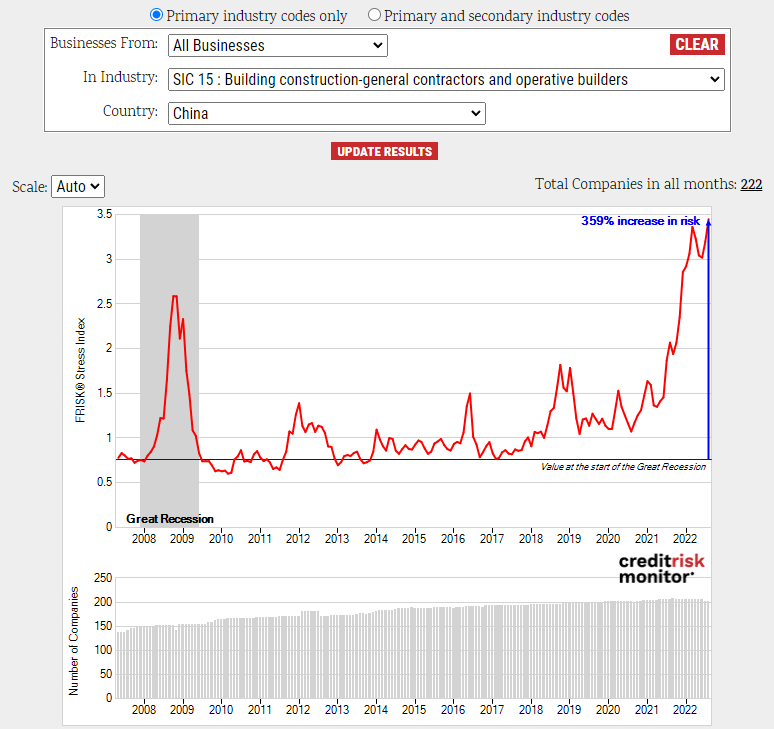

The FRISK® Stress Index for China’s building construction – general contractors and operative builders industry (SIC 15) reached another record of 3.44x in 2022, well above the previous peak of 2.59x in Oct. 2009. This new level signals that aggregated financial stress is more than triple the historical long-term average. This reading also occurred even after adjusting for survivorship bias, where three high-risk property developers dropped from the index due to stock delisting events.

Among the 140 property developers trending in the high-risk "red zone," or those ranked "5" or lower on the "1" (highest risk)-to-"10" (lowest risk) FRISK® scale, many are struggling to access financing. From the list of 28 highly distressed property developers CreditRiskMonitor released in January, the three operators of Risesun Real Estate Development Co., Ltd., Modern Land (china) Co. Ltd., and Fantasia Holdings Group Co., Limited have since filed bankruptcy. However, the cumulative liabilities of $64 billion in these three bankruptcies only scrape the surface of the industry’s trillions in obligations.

| Company | Filing Type | Filing Date | Total Liabilities |

| Risesun Real Estate Development Co., Ltd. | Chapter 15 | Feb. 4 | $37.0 billion |

| Modern Land (China) Co. Ltd. | Chapter 15 | Jun. 3 | $12.9 billion |

| Fantasia Holdings Group Co., Limited | Winding Up Petition | May 24 | $12.5 billion |

Three medium-scale property developers have filed bankruptcy, but dozens more remain vulnerable to failure over the next 12 months.

Among the largest property developers is Country Garden Holdings Co. Ltd. Previously known for being relatively financially stable, the company’s FRISK® score has fallen from “6” in April to a “3.” For Country Garden Holdings’ H1 2022 reporting period, net profits also slid by 96% year-over-year to $92 million USD, which is the lowest mark recorded since H2 2009. When healthier industry peers begin to struggle, that is a clear sign of a systemic problem.

The company recently made an announcement regarding poor industry conditions stating that: “China’s property market has slid into severe depression.” Such an unprecedented statement highlights the severity of the crisis for not just the industry, but also the entire Chinese economy. Today, the real estate industry represents about 29% of China’s GDP, and the trillions of potential losses would mirror or be even more severe than the economic fallout of what transpired in the U.S. during the Great Recession.

China Evergrande Group’s Collapse

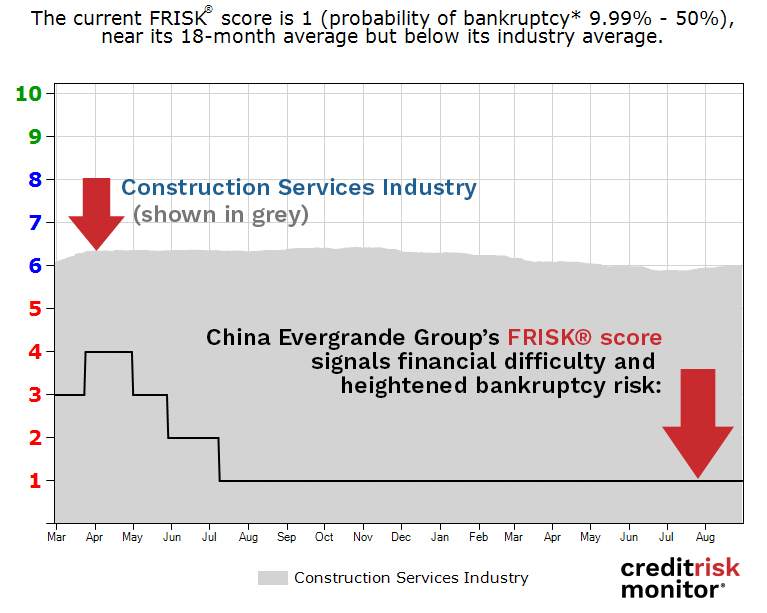

Other property developers have failed to make adequate filing disclosures and/or have delayed issuing their audited financial statements, including China Evergrande Group. China Evergrande Group last reported H1 2021 financial results back in September 2021. In March 2022, the company announced that its FY21 financials would be delayed until its audit process was complete. A series of other red flags also transpired, including:

- In April, China Evergrande Group missed another interest payment and received a six-month grace period

- In May, China Evergrande Group proposed a potential debt-for-equity swap arrangement

- In June, creditors filed a winding up petition; however, China Evergrande Group opposed the motion

- In July, China Evergrande Group missed its own deadline to release a formal restructuring deal

- In August, China Evergrande Group CFO Pan Darong resigned and Hong Kong’s Financial Reporting Council subsequently requested to investigate the financial accounts and audits of the company

Moody’s Investors Service maintains its long-term rating at “Ca” with a negative outlook. Within its latest rating’s rationale, Moody’s cited China Evergrande Group’s heighted liquidity and default risks along with poor recovery prospects on unsecured claims in the capital structure:

“Evergrande’s C senior unsecured rating is one notch below its CFR, reflecting the lower expected recovery rate for its senior unsecured creditors due to structural subordination. This risk reflects the fact that most of the claims are at the operating subsidiaries and have priority over claims at the holding company in a bankruptcy scenario."

Due to the broader industry challenges and a myriad of self-inflicted wounds, China Evergrande Group’s precarious situation has seemingly reached the point of no return. The restructuring process might materialize through a practical plan provided to the courts; otherwise, creditors could collectively force involuntary proceedings. Nonetheless, China Evergrande Group creditors are frustrated, the clock is ticking, and perhaps this long-awaited bankruptcy filing could finally be in view. For a more in-depth review on China Evergrande Group’s financial challenges, read our High Risk Report on the company.

To see which other property developers are approaching bankruptcy, subscribers should access the FRISK® Stress Index and review individual company FRISK® scores.

Bottom Line

China’s real estate industry peaked in late 2020 as the government’s three red lines policy successfully curbed corporate borrowing. We are now arguably observing the largest corporate debt bubble deflating in real-time. The question is whether the PBOC can engineer a soft landing or if such bankruptcies will significantly affect other sectors and economies globally. So far, we have only seen three major property developer bankruptcies with the lion’s share of distressed obligations still outstanding. A gradual versus sudden deleveraging cycle is the difference between manageable risk and grave knock-on effects. If you want to learn more about this debt crisis, contact CreditRiskMonitor to see how you can shield your portfolio and overall business.