CreditRiskMonitor® published a Bankruptcy Case Study on Avaya Holdings Corporation on Feb. 14, 2023. Over the past year, the digital communications products and services company exhibited hallmark signs of increasing bankruptcy risk, both financially and organizationally. We released a High Risk Report on Oct. 17, 2022 as the ongoing problems became increasingly worrisome. Avaya filed for bankruptcy about four months later. This article will provide five quick and vital facts about Avaya that CreditRiskMonitor subscribers were warned about in advance of its bankruptcy.

CreditRiskMonitor is a B2B financial risk analysis platform designed for credit, supply chain, and other risk managers. Our service empowers clients with industry-leading, proprietary bankruptcy models including our 96%-accurate FRISK® Score for public companies and 80+%-accurate PAYCE® Score for private companies, and the underlying data required for efficient, effective financial risk decision-making. Thousands of corporations worldwide – including nearly 40% of the Fortune 1000 – rely on our expertise to help them stay ahead of financial risk quickly, accurately, and cost-effectively.

1. The FRISK® Score Nails It Again

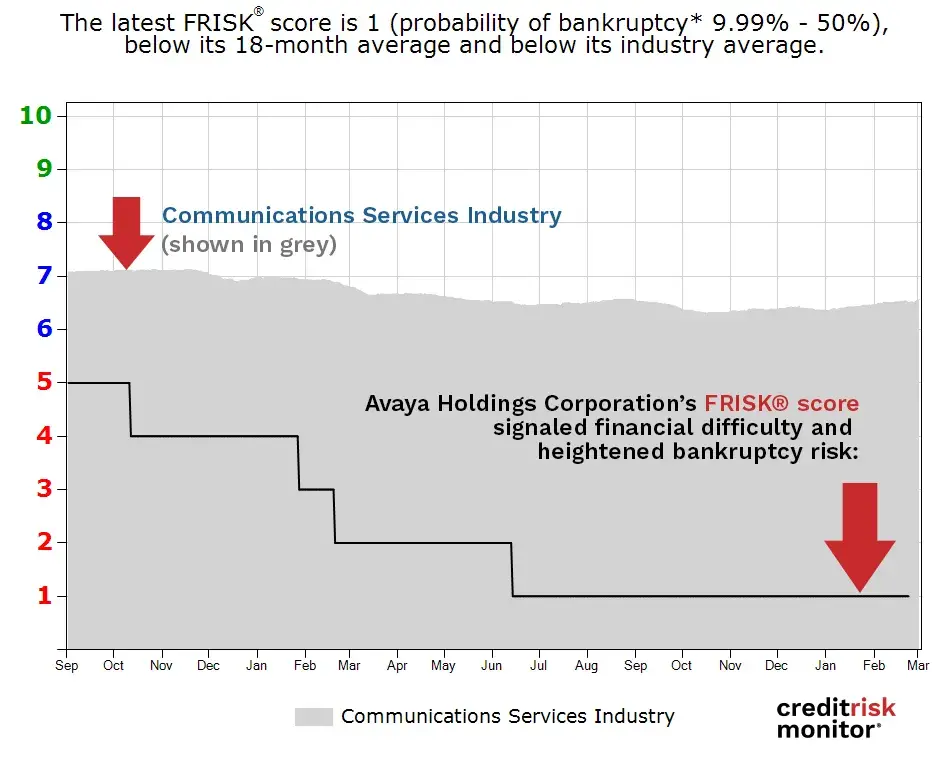

While Avaya reported steady revenue and a placid public-facing exterior in recent years, the forward-looking FRISK® score consistently signaled heighted bankruptcy risk. In Oct. 2021 the FRISK® score stood at a "5," before steadily dropping deeper into the high-risk FRISK® score "red zone," which makes up the bottom half of the "1" (highest risk)-to-"10" (lowest risk) range. By June 2022, Avaya’s score had descended to a "1," which indicated a risk of bankruptcy relative up to 50x larger than that of the average corporation:

The FRISK® score leverages four data components, including:

- stock market performance,

- credit agency ratings from Moody’s, Fitch, and DBRS Morningstar,

- financial ratios, like those found in the Altman Z’’-Score, and

- CreditRiskMonitor subscriber click sentiment data, a.k.a. crowdsourcing

This blend enables the FRISK® score to correctly categorize 96% of companies in the high-risk red zone at least three months prior to filing bankruptcy. Many cases exhibit financial distress closer to one year, however, as exhibited in the case of Avaya.

2. Material Losses and Negative Free Cash Flow

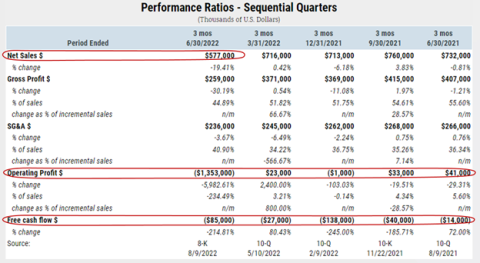

Avaya's financial results were a clear red flag. Beginning in the fiscal period ended Mar. 31, 2021, Avaya reported pre-tax losses in part due to its heavy interest burden. In fact, the company reported pre-tax losses in five of its last six fiscal quarters. The company also reported unceasing free cash flow losses over the same time span. These considerations alone signaled the business would struggle deleveraging its balance sheet and placed significant importance on a top-line recovery.

The sales never improved. In fact, the opposite happened in the fiscal period ending June 30, 2022, when the company disclosed weakness in its subscription services trends. Not only did sales decline by 19.4% quarter-over-quarter, but the company reported an impairment charge of $1.24 billion:

With cash being the lifeblood of any company and Avaya consistently not having produced positive free cash flow, the company was in a precarious position. This aspect is important to consider for a highly indebted firm with limited alternative financing options.

3. Too Much Debt and Coming Due Fast

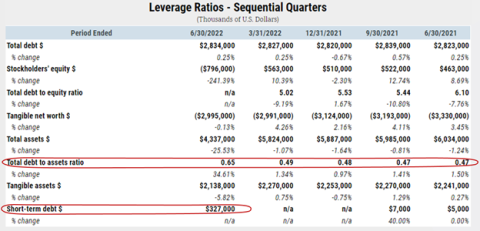

Poor operating results alone usually aren't enough to push a company into bankruptcy. Most often it is poor financial performance coupled with a leveraged balance sheet that is lethal. Avaya's total-debt-to-assets ratio was in the bottom quartile of its peer group, so it would easily fall into the highly leveraged category that counterparties should be worried about.

Yet there was an even more troubling change in the June 30, 2022 quarter as short-term debt increased to $327 million because a material amount of debt naturally shifted from long-term to short-term as it neared maturity. There's nothing inherent wrong with short-term debt, but financially troubled companies often have a difficult time rolling over existing debt, especially in a rising interest rate environment, if they can roll it over at all. Having so much debt due within 12 months started a countdown timer that increased the pressure on management to find a solution. In this case, the company chose to seek out court protections.

4. Out with The Old

Risk professionals should look beyond financials when examining a red zone FRISK® score company. Executive turnover is another highly worrying change that often takes place in financially troubled companies. The red flags were up in major fashion at Avaya on this front, with then-President and CEO Jim Chirico ousted on Aug. 1, 2022, in favor of former Vonage boss Alan Masarek. By November, Chief Revenue Officer Stephen Spears (dismissal), Chief Financial Officer Kieran McGrath (retirement), and an additional board member, Robert Theis, had also left the company.

On top of that, the company announced broader layoffs in September, just a month or so after Masarek’s arrival on the scene. Such money-saving moves are common at companies, but when they happen at a financially troubled company, layoffs suggest a critical need to conserve cash.

5. The Company Finally Gave In

One of the biggest warning signs of a pending bankruptcy is when a company issues a "going concern" statement, which effectively means management or the company's auditors are unsure the company can avoid a bankruptcy. Normally such information is shared in SEC filings, typically in the MD&A section of a Form 10-Q or 10-K. However, on Aug. 9, 2022, Avaya provided a going concern disclosure in a press release and a Form 8-K filing. Once again, subscriber email alerts quickly informed CreditRiskMonitor subscribers that the company was approaching bankruptcy.

After the going concern warning, meanwhile, Avaya made additional moves that were cause for concern. Specifically, the company hired the law firm Kirkland & Ellis LLP and turnaround adviser AlixPartners LLP. Both frequently work with companies that are at risk of bankruptcy.

Bottom Line

One of the problems with bankruptcy is that it is often a process that happens over many quarters, and even years, until the very end when things tend to pick up steam. Poor operating performance, burning through cash, high leverage, near-term debt maturities, management turnover, and the company, finally, stating that it was up against the wall with a going concern notice were all on display with Avaya, but none of these troubling signs are particularly unique. Subscribers are alerted to them on a regular basis, alongside the FRISK® score, so they can take action to mitigate risk exposure. Contact CreditRiskMonitor today if you want to get ahead of looming bankruptcies in your portfolio.