CreditRiskMonitor® published a High Risk Report about Diebold Nixdorf, Inc. on June 6, 2022. The banking and retail technology solutions company continued to deteriorate from that point until ultimately filing for bankruptcy almost exactly one year later. The troubling details of the company's descent are unearthed in our Bankruptcy Case Study. This article will provide five quick and vital facts about Diebold Nixdorf and what CreditRiskMonitor® subscribers – and prospective clients – can do to better protect their portfolio from future bankruptcies like this one.

CreditRiskMonitor is a B2B financial risk analysis platform designed for credit, supply chain, and other risk managers. Our service empowers clients with industry-leading, proprietary bankruptcy models including our 96%-accurate FRISK® Score for public companies and 80+%-accurate PAYCE® Score for private companies, and the underlying data required for efficient, effective financial risk decision-making. Thousands of corporations worldwide – including nearly 40% of the Fortune 1000 – rely on our expertise to help them stay ahead of financial risk quickly, accurately, and cost-effectively.

1. The FRISK® Score Cuts Through the Noise

A common theme with public company bankruptcies is that they continue to pay their bills in a timely fashion right up until failure, known as the “Cloaking Effect.” This effect is why payment tracking risk metrics such as the Days Beyond Terms (DBT) Index (similar to Dun & Bradstreet’s PAYDEX® Score) indicated no imminent risk over the past year at Diebold Nixdorf. In stark contrast, the FRISK® score categorized Diebold Nixdorf as a "1" on the 1-(highest risk)-to-10-(lowest risk) scale, indicating bankruptcy risk of 10-to-50x higher than the average public company.

FRISK® Score | Probability of Bankruptcy Within 12 Months | |

| From | To | |

| 10 | 0.00% | 0.12% |

| 9 | 0.12% | 0.27% |

| 8 | 0.27% | 0.34% |

| 7 | 0.34% | 0.55% |

| 6 | 0.55% | 0.87% |

| 5 | 0.87% | 1.40% |

| 4 | 1.40% | 2.10% |

| 3 | 2.10% | 4.00% |

| 2 | 4.00% | 9.99% |

| 1 | 9.99% | 50.00% |

The FRISK® score achieves such high levels of accuracy through four high-quality data components, including:

- stock market data

- credit agency ratings from Moody’s, Fitch, and DBRS Morningstar

- financial ratios, like those found in the Altman Z’’-Score, and

- CreditRiskMonitor® subscriber aggregated click sentiment data, a.k.a. crowdsourcing

Single-factor models like the DBT Index far too frequently fail to provide adequate warning of increasing risk, especially when evaluating risk at public companies. When a company's FRISK® score falls into the bottom half of the score's range, known as the "red zone," clients should start paying more attention to that high-risk counterparty. It is an early warning system alerting you to consider taking action(s) to adjust risk exposure and avoid a bad debt write-off.

2. More Going Out Than Coming In

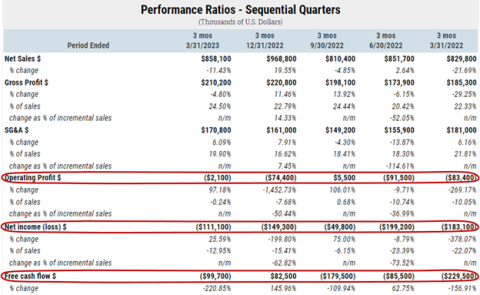

Diebold Nixdorf's revenues have been relatively stable over the past year, but it has posted operating losses in all but one of the last five quarters, and that operating profit was a mere $5.5 million compared to the worst loss over that span of $91.5 million. Net income was negative in each of the quarters.

More problematic was the company's free cash flow. Cash is the lifeblood of any company and if consistent positive free cash flows aren't produced, the company will face financial distress. Diebold Nixdorf produced positive free cash flow in only one of the last five quarters and its cumulative free cash flow for the period was deeply in the red. You need to take particular care when companies with weak FRISK® scores are exhibiting poor financial results.

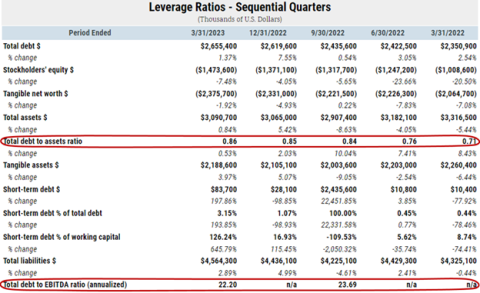

3. Heavily Leveraged and Not Covering It

Compounding weak financial performance here was the company's heavy leverage. Over the past year, the company's debt level rose consistently quarter after quarter pushing up the total debt-to-assets ratio from an already high 71% to an even higher 86%. In the trailing 12 months, total debt-to-EBITDA ratio exceeded 22x, an astonishingly high value and clearly indicating that leverage was a key factor in Diebold Nixdorf’s undoing. To quote Warren Buffett, “When a manager with a reputation for brilliance tackles a business with a reputation for bad economics, the reputation of the business remains intact.” Excessive leverage is a profound example of “bad economics” and with debt levels as high as Diebold Nixdorf’s, there aren’t many managers that could restructure it without succumbing to bankruptcy.

Debt servicing was also an issue as its interest coverage was below 1.00 in each of the last five quarters. Companies with a lot of debt that cannot cover interest expenses are challenged in an elevated interest rate environment.

4. Desperate for More Breathing Room

It might not come as much of a surprise that Diebold Nixdorf was in frequent contact with its lenders, and not in a good way. The company asked for waivers on existing debt covenants and more cash to help fund its operations. Neither are good signs for a company with a FRISK® score of “1.”

CreditRiskMonitor delivered alerts to subscribers with Diebold Nixdorf in their portfolios. On Nov. 7, 2022, an alert was sent about the company's lenders agreement to temporarily waive noncompliance with its net leverage covenant. And then on Mar. 21, 2023, the company tacked on an additional $55 million extension to an existing $250 million credit facility. Given that the company wasn't covering its interest expenses beforehand, this debt expansion was an aggressive, perhaps desperate, move to get the vital cash needed to fund its operations, but that it was unable to generate internally.

5. The Big Warning Nobody Should Ignore

Diebold Nixdorf's Form 10-K annual filing, directly accessible on the CreditRiskMonitor service, disclosed a going concern warning. The going concern warning was repeated in an 8-K filing issued on May, 30, stating:

"As of March 31, 2023 substantial doubt exists regarding our ability to continue as a going concern…The Company may not be able to generate sufficient cash from operations or have access to other sources of liquidity to sustain its operating needs or to meet its obligations as they become due over the next twelve-month period, raising substantial doubt as to the Company’s ability to continue as a going concern."

Repeated going concern warnings are another major red flag, highlighting the lack of progress in improving the condition of the business. As soon as both of the filings were made available subscribers were alerted of the going concern risk. In essence, this alert of the going concern warning further affirmed Diebold Nixdorf’s final stages toward bankruptcy. This type of information can serve as an important supporting detail in deciding to mitigate risk exposure.

Bottom Line

The 96%-accurate FRISK® score provided more than a year of warning about Diebold Nixdorf’s high risk of bankruptcy. Timely news alerts, combined with additional data available on the CreditRiskMonitor service, provided unique insights to help clients make their important business decisions. Contact CreditRiskMonitor today to see how our solutions can improve your risk management processes and workflows.