CreditRiskMonitor® published a High Risk Report about Yellow Corporation (“Yellow Corp.”) in July 2023. Over the past year, the trucking industry has been in a “freight recession,” Yellow Corporation has struggled with an onerous debt load and ongoing red ink, finally declaring bankruptcy on Aug. 6, 2023. Our Bankruptcy Case Study on Yellow Corporation delves into the brutal details of the company's demise.

This article will provide five quick and vital facts about the company and what CreditRiskMonitor® subscribers and prospective clients can do to identify troubling situations within their portfolios before being hit with an unexpected bankruptcy.

CreditRiskMonitor is a B2B financial risk analysis platform designed for credit, supply chain, and other risk managers. Our service empowers clients with industry-leading, proprietary bankruptcy models including our 96%-accurate FRISK® Score for public companies and 80+%-accurate PAYCE® Score for private companies, and the underlying data required for efficient, effective financial risk decision-making. Thousands of corporations worldwide – including nearly 40% of the Fortune 1000 – rely on our expertise to help them stay ahead of financial risk quickly, accurately, and cost-effectively.

1. Trust The FRISK® Score, Not Payment History

The "Cloaking Effect" was in full swing with Yellow Corporation, as the trucking business continued to pay its bills in a timely fashion over the past year. Payment metrics such as the Days Beyond Terms (DBT) Index (like Dun & Bradstreet’s PAYDEX® Score) showed little-to-no indication of risk. The CreditRiskMonitor FRISK® score, however, warned of sizable risk potential more than 12 months before Yellow Corporation’s bankruptcy.

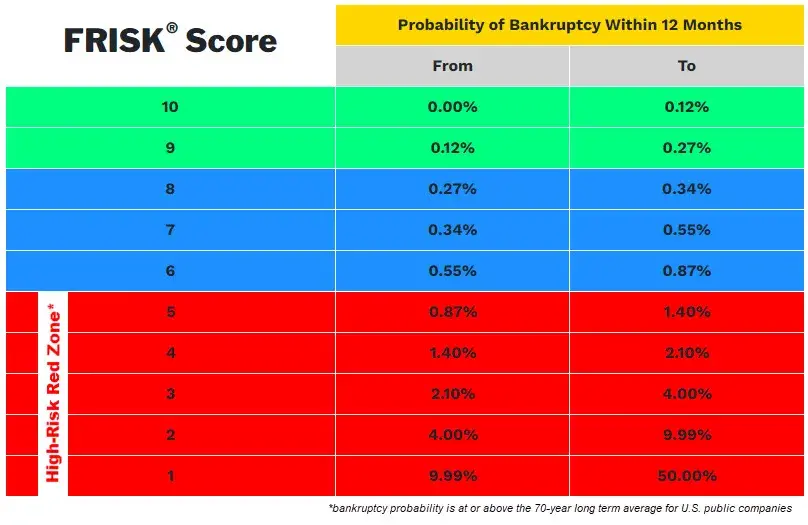

To wit, in October of 2022 the FRISK® score fell to the worst-possible score of "1" on the 1-(highest risk)-to-10-(lowest risk) scale, indicating bankruptcy risk was 10-to-50x higher than the average public company.

The FRISK® score achieves 96% predictive accuracy for bankruptcy by combining four high-quality data components, including:

- Crowdsourcing, or the aggregated risk sentiment of CreditRiskMonitor® subscribers indicated by their group activities on the platform

- Stock market data, including volatility and market capitalization trends

- Credit agency ratings from Moody’s, Fitch, and DBRS Morningstar

- Financial statements, factoring in ratios similar to, but in excess of the Altman Z’’-Score

The DBT Index – and other payment performance-focused models – far too frequently fail to provide adequate warning of bankruptcy risk. This situation is especially true when they are used to evaluate public companies, which have greater access to capital markets than private companies. When a company's FRISK® score falls into the bottom half of the score's range, known as the "red zone," clients should start paying more attention to that high-risk counterparty. It is an early warning system alerting you to consider taking action(s) to adjust risk exposure and avoid bad debt write-offs. When the score falls all the way to the riskiest classification of "1," extreme caution is required.

2. Losing Traction

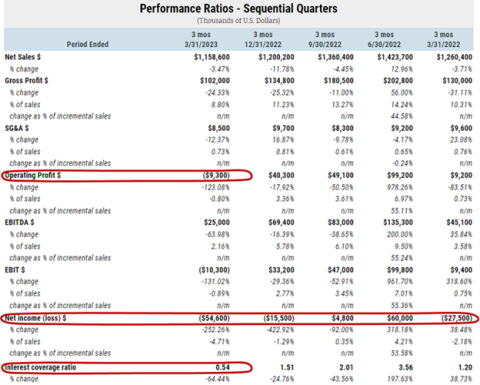

Yellow Corporation's revenue had been essentially flat for over a decade. Far more troubling were the ups and downs on the net income line, where the figure was negative in three of the past five quarters. Cumulatively, the company lost $32.8 million over that span.

Notably, operating profit turned negative in the first quarter of 2023. So, too, did earnings before interest and taxes. With the red ink, Yellow Corporation also failed to cover its interest costs in the quarter, with coverage falling into the bottom quartile of its peer group. While things have been difficult for a while, the financial strain and Teamsters' negotiation clearly took a turn for the worse, helping to push the company over the edge.

3. Bleeding Cash, Up and Down the Highways

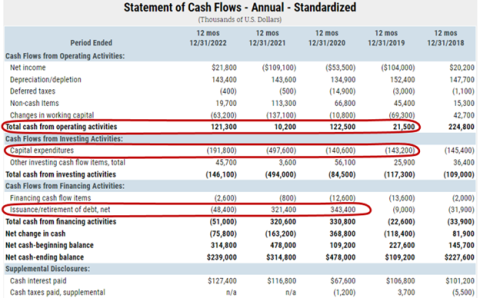

A key part of Yellow Corporation's business was shipments by truck, with big rigs that are expensive to buy and maintain. Capital investment is a consistent demand on cash – problematic for a company that has posted negative free cash flow in three of the past five quarters. In fact, free cash flow had been negative in four of the past five fiscal years, ultimately burning $618.3 million over that period.

Cash is king, but Yellow Corporation wasn't generating enough of it to keep spending in support of its capital-intensive business. Although shortfalls can be made up in other ways, such as selling shares or issuing debt, long-term spending in excess of operating cash flow will almost always end in bankruptcy.

4. A Leverage Truckload

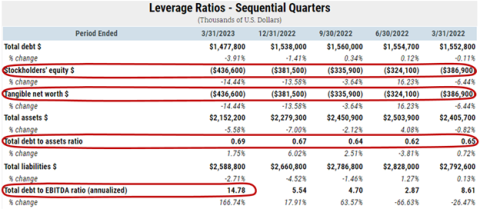

A sign that a company is spending too much cash can often be found on the balance sheet in the form of increasing leverage.

Yellow Corporation's debt increased by 75% between 2018 and 2022. Although it was able to reduce debt levels slightly in the first quarter of 2023, ongoing losses continued to push shareholder equity and tangible net worth deeper into negative territory.

The first quarter's total debt-to-assets ratio of 69% was higher than it has been in any of the past five fiscal years. The same was true for debt-to-EBITDA, which sat at a troubling 14.8 times at the end of that first quarter. Both of those figures placed Yellow Corporation in the bottom quartile of its peer group. A company that lags its peers on multiple financial metrics must be monitored closely.

5. When Debt is Set to Mature, Get Out of Dodge

Weak earnings, negative free cash flow, and an increasingly onerous amount of leverage all should have made the company's de minimis cash balances and a weak cash ratio a less-than-shocking revelation. In its first quarter 2023 10-Q filing, the company disclosed via the Management, Discussion, and Analysis (MD&A) section that the company was facing notable debt maturities in 2024 that pushed Yellow Corporation's back against the wall:

"…the Company has $567.4 million in debt due June 30, 2024 and $729.4 million in debt due September 30, 2024. At March 31, 2023, the Company had cash and cash equivalents and Managed Accessibility of $167.5 million. On or before the maturation of debt in 2024, the Company will require substantial additional liquidity to satisfy these debt obligations."

To preserve liquidity while racing to turnaround performance, the Company even went so far as to defer payments for union healthcare and pensions. CreditRiskMonitor subscribers are strongly encouraged to read the MD&A for any company about which they harbor financial concerns. Companies facing financial troubles often must make difficult tradeoffs. In this case, Yellow Corporation's austere policy measures increased the tension between it and its union members. However, with limited alternative options, a high-stakes game of chicken with the union seemed like the best available choice. The public nature of the standoff, and the ever-present threat of a strike, pushed customers to move their business to Yellow’s competitors to ensure against any potential disruptions to their logistics, exacerbating Yellow Corporation's troubles and hastening its demise.

Bottom Line

Yellow Corporation's financial situation was increasingly perilous even as payment-based metrics like the DBT Index failed to signal risk. CreditRiskMonitor subscribers wielding the FRISK® score, however, were forewarned and had the resources at their fingertips to dig into the details within the service.

Contact CreditRiskMonitor today to find out how you can put these vital risk tools to work in your company.