Credit Research Foundation 2026 March Forum

Event Overview

Location: Charleston Marriott, 170 Lockwood Boulevard, Charleston, SC 29403

Date: Monday-Wednesday, March 23-25, 2026

CRF Event: Registration Details

About: CreditRiskMonitor will be attending the Credit Research Foundation's upcoming March Forum. This forum will deliver a concentrated lineup of sessions designed to help credit, finance, and order-to-cash leaders navigate the operational, economic, and technological shifts shaping 2026.

Join us at the event to discuss strategy, best practices, our latest solutions, and more. We look forward to seeing you there!

Why You Should Meet With Us:

Bolstering The Credit Community

CreditRiskMonitor has rejoined the Credit Research Foundation to deepen our engagement with leading credit professionals and contribute to the ongoing advancement of industry best practices. We look forward to reconnecting with peers and participating in the Foundation’s March forum.

Delivering Expert Insight

For over 25 years, CreditRiskMonitor has provided expert insights in bankruptcy prediction, credit limits, financial risk assessment, and more. Our data-driven approach helps organizations strengthen credit decisioning across their portfolios and accounts receivable.

Strategic AI Advancements

We have introduced many powerful

AI-driven solutions that enable clients to stay ahead of financial risk quickly, accurately, and cost-effectively. Combining innovative technology with a “human-in-the-loop” approach, we enhance our solutions, expand coverage, and streamline client processes.

Access Our Latest Research

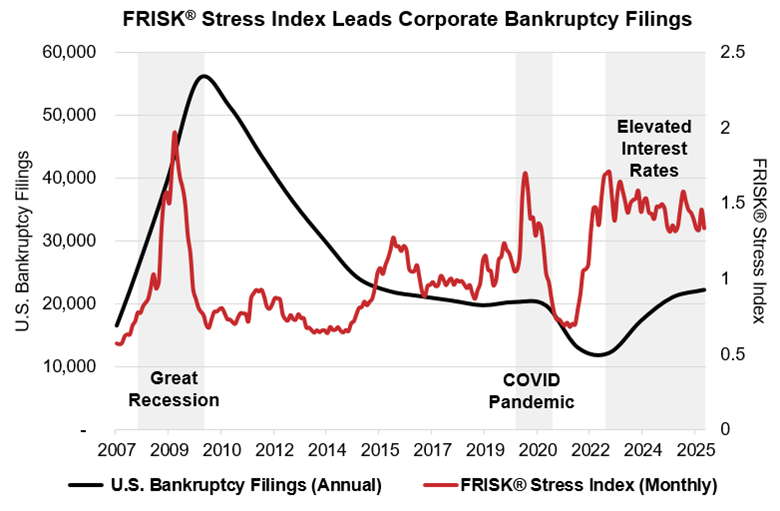

In 2025, U.S. corporate bankruptcies increased for the third consecutive year. Total Chapter 11 and Chapter 7 bankruptcies climbed above 22,000, about 18% higher than the 10-year average of approximately 18,700. Trailing 12-month Q3 2025 bankruptcy filings also reached a 11-year high, according to U.S. Courts data.

Chart of the Day: CreditRiskMonitor’s U.S. FRISK® Stress Index remains in high-risk territory. The FRISK® Stress Index aggregates public company FRISK® Scores to predict financial stress over the next 12 months (by industry, geography, or portfolio). In 2026, the U.S. FRISK® Stress Index reached 1.3%, above the average annual corporate bankruptcy rate of 1%.

Based on this trend in the FRISK® Stress Index, we anticipate that bankruptcy filings will remain elevated over the next 12 months. Our clients also use this tool on their portfolios to better understand their unique risk exposure.