The Financial Analyst Strength Test (FAST) Rating assesses foreign private companies with limited financial data. This model combines advanced machine learning technology with the expertise of CreditRiskMonitor’s seasoned financial analysts to accurately predict a private company’s likelihood of financial distress.

Resources

Stay Ahead With In-Depth Analytics on Public And Private Companies

Explore how the PAYCE® Score delivers industry-leading financial risk prediction on private companies without financial statements.

SupplyChainMonitor™ is a powerful, web-based risk monitoring platform for supply chain professionals. By continuously tracking and alerting you to changes in the financial health of every company in your supply chain, you can stay ahead of emerging risks. You can address potential bankruptcies, financial distress, geopolitical disruptions, climate events and compliance risks before they impact your operations.

Learn how we combine cutting-edge technology with disciplined human oversight to deliver accurate, transparent data. AI and machine learning helps us bolster our industry-leading financial risk models, process financial statements quickly, and provide FAST Ratings at scale. We also adhere to responsible AI practices.

The Risk Level helps clients make faster decisions across 10+ million public and private companies by providing a summary view of their financial risk level.

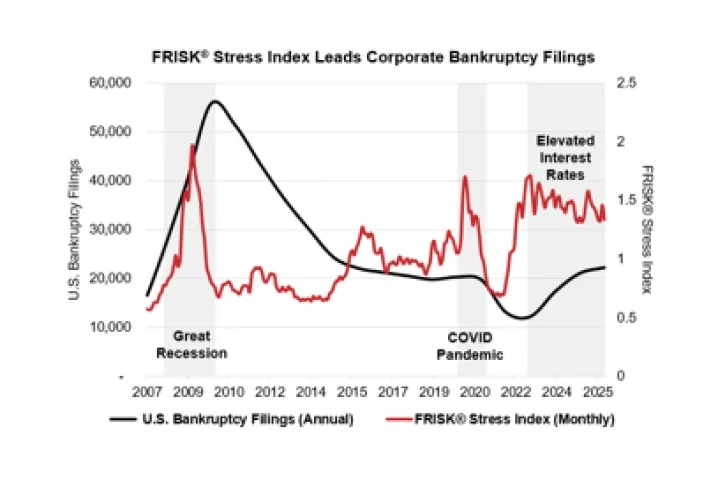

In 2025, U.S. corporate bankruptcies increased for the third consecutive year. Total Chapter 11 and Chapter 7 bankruptcies climbed above 22,000, about 18% higher than the 10-year average of 18,700. Trailing 12-month Q3 2025 bankruptcy filings also reached a 11-year high, according to U.S. Courts data.

CreditRiskMonitor.com, Inc. is pleased to announce that its SupplyChainMonitor™ solution has been recognized once again as a top procurement technology – now in the Spend Matters Fall 2025 SolutionMap.

Get a closer look at how the FRISK® Score delivers industry-leading financial risk prediction. Nearly 40% of the Fortune 1000 and over a thousand other corporations worldwide use this model in their workflows.

CreditRiskMonitor.com, Inc. reported operating revenues of $5.1 million, an increase of approximately $85 thousand or 2%, for the third quarter of fiscal 2025 compared to the same period of fiscal 2024.