Tesla is calling upon suppliers to negotiate new prices and payment terms to improve cash flow. CreditRiskMonitor explores with Supply Chain Dive the consequences of Tesla's increased demands upon suppliers.

Resources

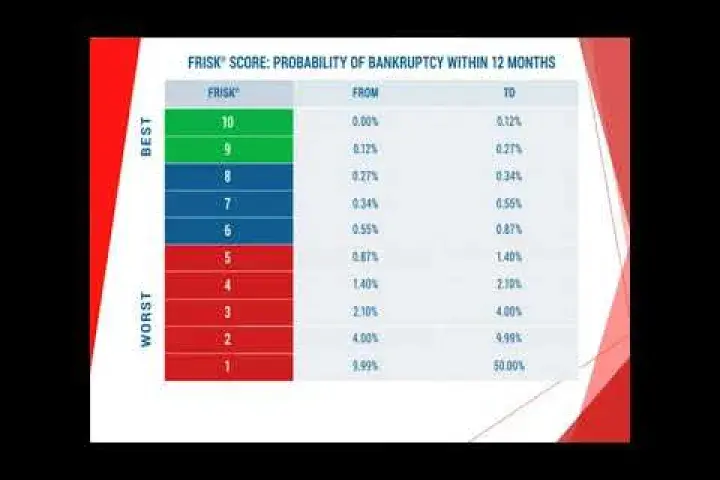

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

Resilinc Corporation and CreditRiskMonitor.com, Inc. are forming a partnership, aiming to enable Fortune 1000 organizations to achieve greater visibility when it comes to gauging financial health of suppliers and overall supply chain risk.

Of all the sources of risk supply chain managers face on a daily basis, none is currently at an inflection point quite like debt, as explained by CreditRiskMonitor President William Danner in this article for Inbound Logistics.

CreditRiskMonitor President William Danner writes in this feature for Food Logisitics about the common signals every business should look for to monitor insolvency risk in the supply chain.

Financial stability is the bedrock of supply continuity. In collaboration with The Hackett Group, this brochure highlights how procurement professionals can transcend the current volatile atmosphere by leveraging predictive analytics to streamline operations and eliminate unnecessary exposure.

Supply Chain Dive's Emma Cosgrove interviewed CreditRiskMonitor CEO Jerry Flum regarding the level of risk suppliers of Tesla, Inc. face in the wake of the company's recent cash flow problems.

Supply & Demand Chain Executive Webcast: Predictive Analytics

Our very own Dr. Camilo Gomez, CreditRiskMonitor Senior Vice President, Quantitative Research, spoke about the value that predictive analytics is providing to procurement professionals in this webinar.

CEOCFO Magazine recently spent some time with CreditRiskMonitor President & COO, Mike Flum, to learn about our company and the treacherous landscape both credit and procurement risk evaluators are traversing in this age of rising debt, inflation, and interest rates the world over

With escalating geopolitical tensions and heavy sanctions hitting Russia and China, corporations are sourcing alternative suppliers from other countries.