One Year In: The COVID-19 Pandemic Pushes Financial Risk to the Limit

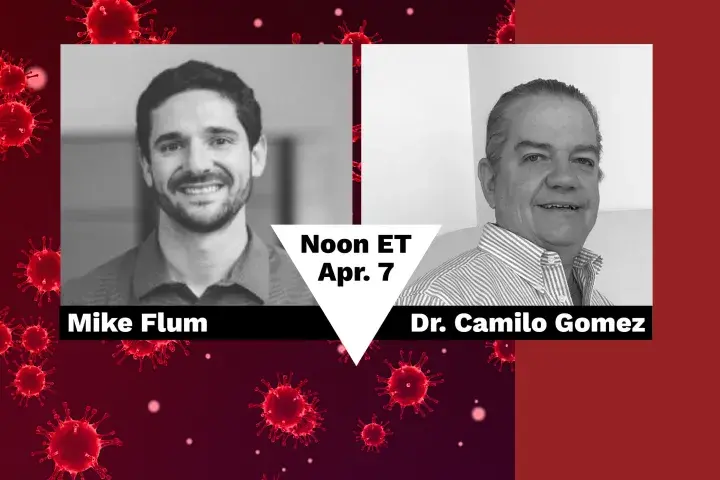

Join CreditRiskMonitor's President & COO Michael Flum and Sr. VP of Data Science Dr. Camilo Gomez for a look back at the volatile year that was in 2020 and how the FRISK® score was instrumental in making financial risk evaluators aware of potential bankruptcies far earlier than by using other models.