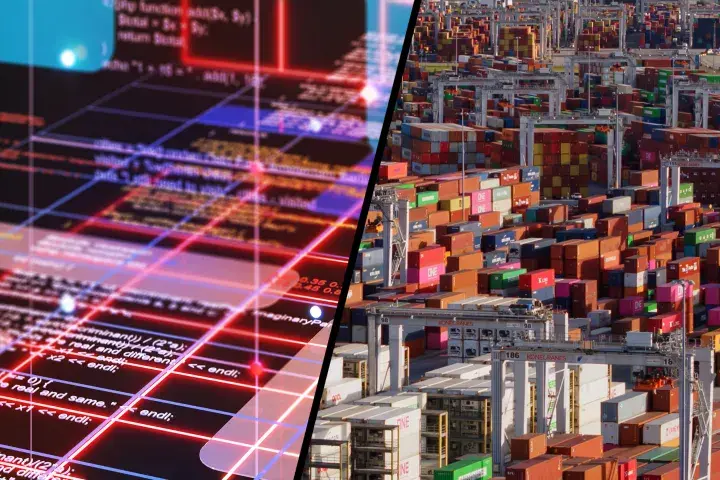

Armed with CreditRiskMonitor’s SupplyChainMonitor product, procurement teams worldwide are restructuring by onshoring, nearshoring, and avoiding increasingly risky countries.

Resources

Stay Ahead With In-Depth Analytics on Public And Private Companies

Risk professionals like yourself are preparing for another economic downturn and our API will enhance your workflows. This scalable data provides automation for supply chain analysis, reviewing prospective vendors, and RFP processes.

CreditRiskMonitor.com, Inc. is pleased to announce that its SupplyChainMonitor™ solution has been recognized once again as a top procurement technology – now in the Spend Matters Fall 2025 SolutionMap.

Financial stability is the bedrock of supply continuity. In collaboration with The Hackett Group, this brochure highlights how procurement professionals can transcend the current volatile atmosphere by leveraging predictive analytics to streamline operations and eliminate unnecessary exposure.

Our Distressed Supplier Report leverages advanced predictive analytics to assess major supplier, Spirit AeroSystems and its heightened financial risk. Powered by SupplyChainMonitor™, procurement and supply chain professionals gain access to actionable insights for proactive identification and mitigation of supplier-related disruptions.

In this Distressed Supplier Report, the near-term fate of Enviva, Inc. is discussed: why this supplier is in trouble, which SupplyChainMonitor™ features are unearthing Enviva's hidden dangers, and the contingency plans procurement professionals must make to keep their supply chain intact in the face of the company's ballooning financial risk level.

CEOCFO Magazine recently spent some time with CreditRiskMonitor President & COO, Mike Flum, to learn about our company and the treacherous landscape both credit and procurement risk evaluators are traversing in this age of rising debt, inflation, and interest rates the world over

In this Distressed Supplier Report, the near-term fate of Triumph Group, Inc. is discussed: why this supplier is in trouble, which SupplyChainMonitor features are unearthing Triumph Group's hidden dangers, and the contingency plans procurement professionals must make to keep their supply chain intact in the face of the company's ballooning financial risk level.