CreditRiskMonitor published a High Risk Report on Bed Bath & Beyond Inc. on Aug. 22, 2022. The troubled retailer has been promptly paying its bills for larger suppliers, but that is not as reassuring as it sounds. Most companies that file bankruptcy continue to pay on time until they declare, cloaking the actual risk facing trade creditors and other counterparties. This detailed report will provide five quick and important facts that illustrate Bed Bath & Beyond’s increasingly troubled situation and highlight early warning signs to look for in other struggling companies.

1. Rock-Bottom FRISK® Score Indicates Tip-Top Financial Stress

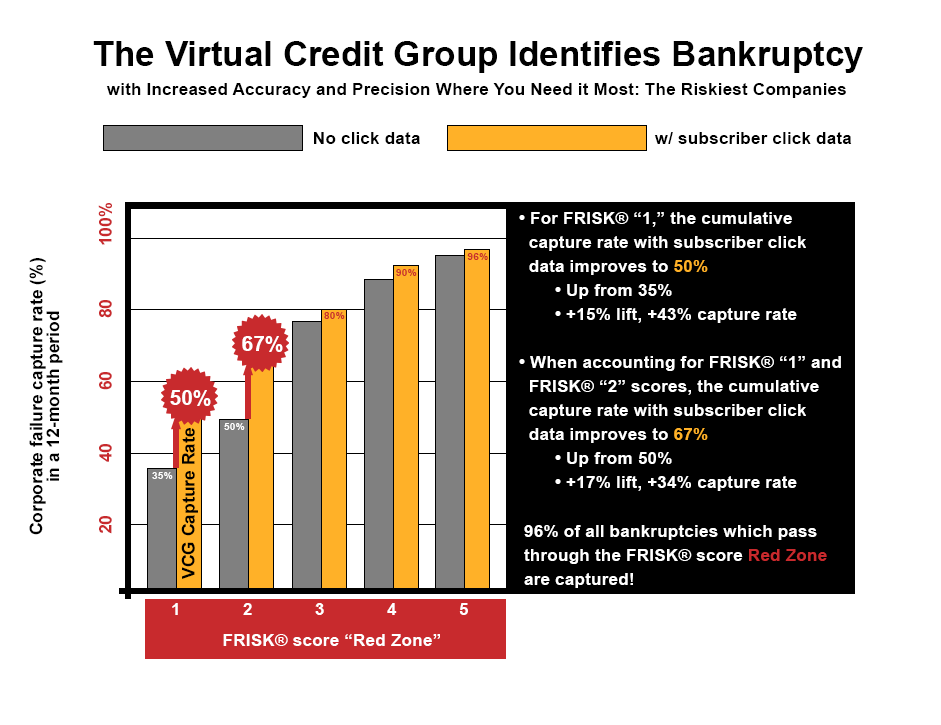

Bed Bath & Beyond Inc. carries the worst-possible FRISK® score of "1," which indicates that it has a 10-to-50x higher risk of bankruptcy than the average public company. The score here has been mired in the bottom half of the FRISK® score's "1" (highest risk)-to-"10" (lowest risk) range, which we call the "red zone," since the start of 2022. This trend is a red flag for Bed Bath & Beyond Inc. because 96% of public companies that eventually go bankrupt have been in the red zone for at least 3 months before filing. Moreover, 67% of like companies will have dropped to either at a FRISK® score of "1" or "2” within the three months prior to the day they finally seek out court protections – a stat that we can glean via analysis of CreditRiskMonitor subscriber crowdsourcing data:

CreditRiskMonitor's FRISK® score cuts through the “cloaking effect,” or a phenomenon that describes the faulty practice of considering past payment behaviors as a prime indicator of future bankruptcy risk levels in public companies. In contrast, the FRISK® score does not use payment information for public companies and goes further analytically to deliver the 96% accuracy rate in bankruptcy prediction. Instead, it non-linearly blends high-quality data inputs including financial statements, credit agency ratings, stock performance, and the aggregate crowdsourced research behavior of CreditRiskMonitor's subscribers.

To speak more about the proprietary subscriber crowdsourcing, our company has created a "Virtual Credit Group;" CreditRiskMonitor subscribers, through their natural collective behavior in research, have greatly increased the capture rate of the FRISK® score in recent years. When thousands of individuals who are highly influential minds in the daily commerce in some of the world’s largest corporations – making decisions affecting billions of dollars of purchase and sale transactions annually – show concern, working capital risk increases.

2. Cash Flow Flop

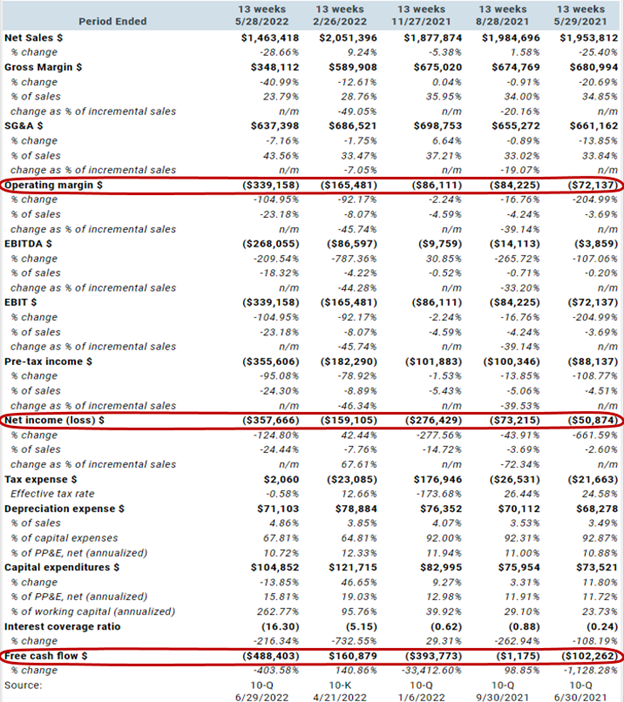

Bed Bath & Beyond Inc.’s financial condition deteriorated gradually… and then suddenly. The company has been bleeding red ink and has shown negative cash flow for more than a year. Notably, net sales fell in the fiscal period ending May 28, 2022, by a painful 25% year-over-year. SG&A expenses, however, barely moved, leading to a dramatic decline in the company's operating margin, which is an unsustainable trend.

3. This Zombie May Not Eat Brains, But It Doesn't Cover Interest Costs, Either

Bed Bath & Beyond Inc., like numerous other public companies worldwide, has not been able to cover its interest expenses. Over the last two quarters, interest coverage has been particularly weak. This factor puts the retailer soundly into the zombie company category. Historically low interest rates made rolling over debt easy and interest coverage was something that many overlooked. Rising interest rates and higher economic risks are pushing companies, like Bed Bath & Beyond Inc., onto a much more difficult path. They need to be careful about juggling new projects, investment opportunities, and managing existing debt burdens. Bed Bath & Beyond Inc. is only one example of a zombie company: it’s a widely held belief by economists – and one that CreditRiskMonitor endorses – that U.S. Federal Reserve data severely understates the number of such entities that exist today.

4. C-Suite Shake-Up

In September of 2021, Bed Bath & Beyond Inc.'s Chief Brand Officer, Cindy Davis, resigned. Then three months ago, Chief Executive Officer Mark Tritton (who was handpicked for the role after a successful tenure with Target Corporation), Chief Accounting Officer John Barresi, and Chief Merchandising Officer Joe Hartsig all stepped down within three weeks. Although movements among senior staff aren't in and of themselves aren't worrisome, it is when you see leadership turnover at companies that are struggling financially. These resignations coincide with Bed Bath & Beyond Inc.'s overexpansion (it is now working to close stores), a move toward private label brands that proved ill-timed, and global supply chain headwinds that further weakened the company's business. That said, departures like these frequently precede bankruptcy filings. When combined with the retailer's troubling FRISK® score, this is a warning sign that cannot be ignored.

5. Losing with Leverage

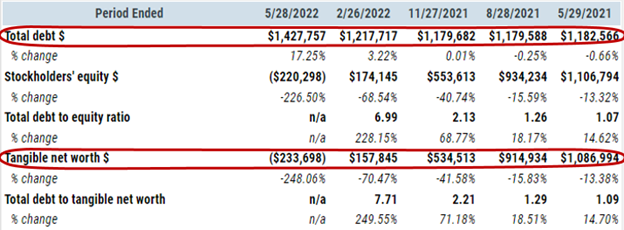

Given the weak financial performance, inability to cover interest expenses, and other warning flags at Bed Bath & Beyond Inc., you might expect the company to be working on mending its balance sheet. The problem is that financially weak companies often end up going in the exact opposite direction. For example, Bed Bath & Beyond Inc.'s total debt increased in each of the last three quarters. Total debt was up 20% year over year in the May quarter. Combined with the ongoing operating losses, which pushed tangible net worth into negative territory, Bed Bath & Beyond Inc.'s financial leverage has skyrocketed over the past year:

Bottom Line

Bed Bath & Beyond Inc.'s business model and underlying supply chain are struggling. Add in elevated leverage and an inability to cover interest expenses, and this retailer looks like it is teetering on the edge of disaster. The FRISK® score provided an early warning of these problems at the start of 2022 and the situation has only worsened. If you count Bed Bath & Beyond Inc. as a counterparty, you should be looking for ways to manage your risk. Contact CreditRiskMonitor today so we can help you identify other risky names, like Bed Bath & Beyond Inc., in your portfolio.