CreditRiskMonitor recently published a High Risk Report on pharmacy retail chain Rite Aid Corporation. This detailed report will provide five quick and important facts that you need to know about this financially weak drug store operator.

1. A Red Zone Retailer, Through and Through

The average FRISK® score for the broader retail (drugs) peer group is around "6", and Rite Aid Corporation's score is "1." This is the lowest possible rating on the “1” (highest risk)-to-“10” (lowest risk) FRISK® score scale, representing bankruptcy risk potential that is 10-to-50x that of the average publicly traded company over the coming 12 months. Note that with the median peer group, the cumulative risk level of “6” is slightly safer than the long-term average rate of 1% for publics.

Although there was a brief rise to "3" in November 2021, Rite Aid Corporation's FRISK® score quickly descended back to "1" again by February 2022. 96%+ of all companies that go bankrupt find themselves with a FRISK® score of “5” or less, the "red zone," at least three months prior to a bankruptcy filing and 67% of them have a FRISK® score of “2” or less. Thus, Rite Aid Corporation has needed close monitoring for more than a year -- even conceding the fact that it has been promptly paying its bills the entire time. On-time bill payment, we’ve seen time and time again with publicly traded companies with unfettered access to capital, which can cloak the true risks. Most public companies continue to pay bills on time right up until the day they file – past payments *do not* predict future behavior or accurate risk assessment.

2. Unhealthy Losses

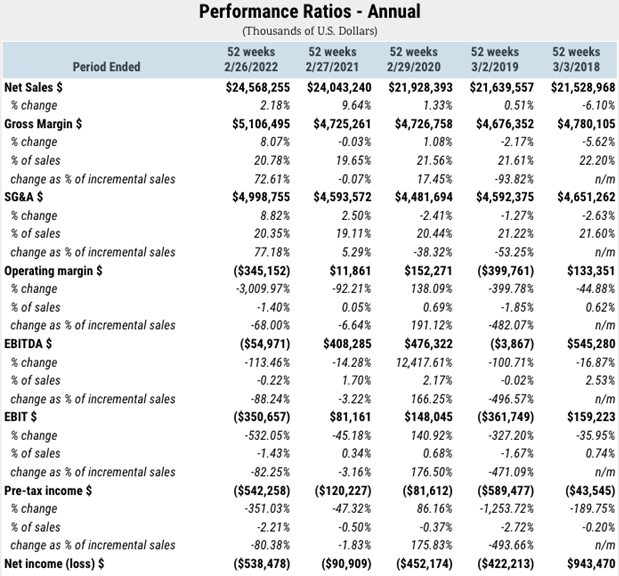

One of Rite Aid Corporation's biggest problems has been an inability to turn a profit, with negative net income in each of the last five quarters. This trend, however, is hardly new, as the pharmacy operator has lost money in each of the last four years, starting in 2019. This trend highlights that Rite Aid Corporation's troubles predate the coronavirus pandemic: the company's $542 million loss in the fiscal year ended 2021 was, in fact, the worst result over this difficult period of recurring red ink. While the pandemic is an added pressure here, there are company-specific problems.

3. Weak Interest Coverage

Although it may not be surprising given the losses Rite Aid Corporation has been recurring, it's important to highlight that interest coverage dipped well into negative territory in the most recent fiscal year. Operators that cannot cover their interest expenses are often referred to as zombie companies, as they limp along at the largess of some of their most important creditors. Even prior to this decline in interest coverage, however, the company's ability to make interest payments was weak. Still, the current falloff is troubling in that it could quickly turn into a bigger problem if lenders decide to tighten the screws on the company now that interest rates are rising.

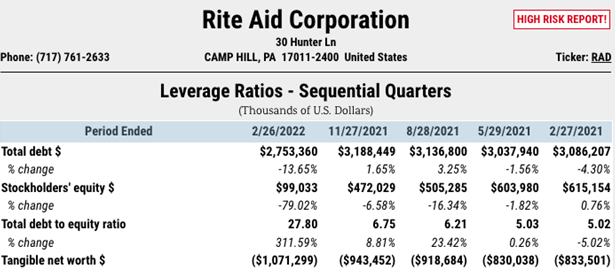

4. Plunging Stockholders’ Equity

Adding to the dilemma is that the company's ongoing losses have pushed stockholder's equity to a scant $99 million. That figure was $615 million just one year ago. This decline has forced tangible net worth further and further into negative territory. At the end of fiscal 2022, tangible net worth was roughly negative $1.1 billion, much worse than what it was at the end of 2019. Negative tangible net worth means that there is little capacity to support additional debt and often limitations on pushing out maturities when existing debt comes due. Rite Aid Corporation transacted several debt exchanges in 2020, but at the expense of higher interest rates despite the historically low interest rate environment at the time. In other words, refinancing its debts is already more troublesome.

5. Working Capital Is All Dried Up

Rite Aid Corporation is distressed, but it is even worse when you look at working capital. This measure of a company's ability to finance daily operations has fallen by nearly 50% over the past year and is around one-third of the company's working capital levels at the end of FY19. Adding to the financial strain is the meager cash balance of nearly $40 million at the end of FY22, a fraction of the $161 million it had at the start of FY21. If these trends continue, Rite Aid Corporation may not be able to avoid bankruptcy.

Bottom Line

Financially troubled companies like Rite Aid Corporation can be carried forward with the help of creditors – for a time. If zombie companies can't surmount the headwinds they face, they eventually run out of rope. Rising rates and the risk of a recession have evaporated much – if not all – of the goodwill lenders are providing to Rite Aid Corporation. Contact CreditRiskMonitor today to see how you can use the FRISK® score to identify and address your counterparty risks.