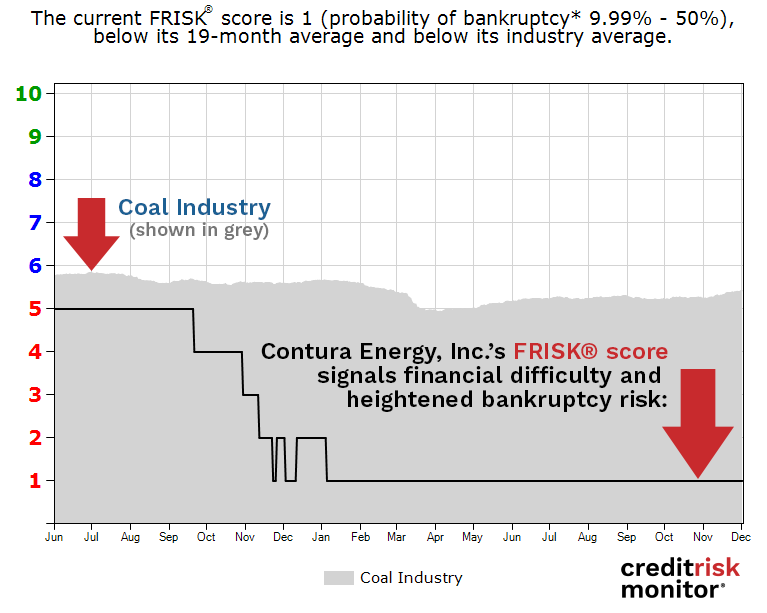

Metallurgical and thermal coal producer Contura Energy Inc. emerged from bankruptcy in November 2018. The coronavirus has reignited challenges for the company and for the coal industry in general, with the price of coal dropping towards multi-year lows. While Contura Energy continues to pay its bills promptly, the FRISK® score has been indicating that the Tennessee-based company is experiencing severe financial distress, particularly relative to industry peers.

Piercing the Cloaking Effect

Contura Energy’s Days Beyond Terms (DBT) Index averaged an “8” over the past year, indicating that dollar-weighted payments have been made relatively promptly. During the last three months, in fact, about 86% of their trade payments are current, with minimal amounts landing in the 1-30 days past due bucket. Scores and ratings that use payment patterns to assess financial risk (e.g. Dun & Bradstreet’s PAYDEX® score) likely indicate strong or adequate financial health. However, Contura Energy’s FRISK® score of “1” indicates a 10-to-50x greater risk of bankruptcy relative to the average public company.

This disparity between healthy payment behavior and financial distress is commonly known as the “Cloaking Effect”, a phenomenon CreditRiskMonitor persistently warns about. Contura Energy’s FRISK® score is derived from four unique data factors, including:

- Weak stock performance; liabilities exceeding market capitalization by 12x

- Poor financial trends; negative EBIT, accumulated deficit, and high financial leverage

- Junk credit rating; Corporate Family Rating of Caa1 provided by Moody’s Investors Service

- Pessimistic crowdsourcing; subscriber research patterns indicate persistently high concern

Contura Energy’s Management, Discussion, and Analysis (MD&A) report to the SEC also reveals red flags:

“A breach of the covenants in the Credit Agreement and the Amended and Restated Asset-Based Revolving Credit Agreement could result in a default under the terms of the agreement and the respective lenders could elect to declare all amounts borrowed due and payable. Pursuant to the Amended and Restated Asset-Based Revolving Credit Agreement, during any Liquidity Period (capitalized terms as defined in the Amended and Restated Asset-Based Revolving Credit Agreement), our Fixed Charge Coverage Ratio cannot be less than 1.0 as of the last day of any Test Period, commencing with the Test Period ended immediately preceding the commencement of such Liquidity Period.” (Emphasis added.)

Bottom Line

Contura Energy demonstrates healthy payment behavior on its invoices despite facing financial difficulty. This pattern is common with public companies in peril and is so prevalent that it has been labeled “The Cloaking Effect” by the credit community. It frequently misleads risk professionals about the underlying financial stress facing a company. Presently, Contura's poor FRISK® score and alarming MD&A disclosures indicate that their bankruptcy risk is elevated, particularly relative to industry peers. Contura’s counterparties should be carefully monitoring and mitigating their risk exposure. Contact CreditRiskMonitor today to see what other companies are exhibiting the Cloaking Effect.