For perceptive CreditRiskMonitor subscribers, McDermott International, Inc.'s bankruptcy was not a surprise. Counted in that group of well-informed evaluators is nearly 40% of the Fortune 1000. When they’re concerned, working capital risk increases.

CreditRiskMonitor had been providing a shrill warning siren for more than a year about McDermott International via the FRISK® score. And in January, a Chapter 11 filing followed. Proven and accurate FRISK® score foresight into public company bankruptcy risk gives you a major edge – here’s how it works.

The First Big Warning

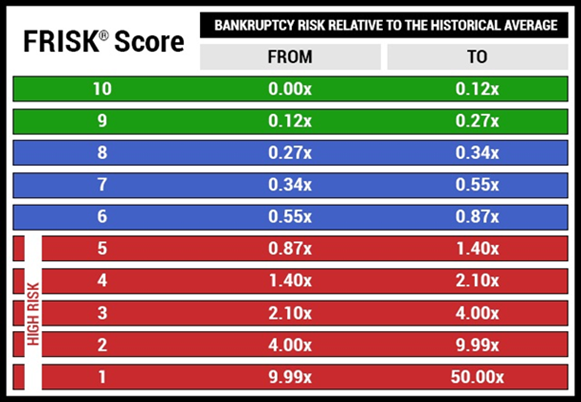

McDermott International’s FRISK® score fell to the worst-possible rank of "1" in May 2019. When looking up the FRISK®, you’ll encounter a database of thousands of public companies accounted for on a "1" (highest risk)-to-"10" (lowest risk) scale. The FRISK® score predicts public company bankruptcy risk over a 12-month period with 96% accuracy. The score incorporates a blend of financial statement ratios, stock market performance, bond agency ratings, and the crowdsourced behavior of CreditRiskMonitor subscribers to deliver a simple, easy-to-comprehend metric.

A score of "5" or lower puts a company into the high-risk FRISK® score "red zone," which is when business counterparties need to start paying attention. When a score hits "3", it is then time for more aggressive actions, including making changes in risk exposure and sourcing alternate suppliers or customers. A FRISK® score of "1," which indicates 10x to 50x higher risk of bankruptcy compared to the average public company, is a warning that you cannot ignore.

Yet getting there is a process, as a deeper look at McDermott International's descent shows.

McDermott International's troubles started to pick up steam following its debt-fueled acquisition of competitor Chicago Bridge & Iron in May 2018. By October of that year, its FRISK® score was "5", meaning that CreditRiskMonitor subscribers should have had it on their radar screens. By the start of 2019, it was a "3," when we suggest starting to take a closer look at your relationship. By the time McDermott International's FRISK® score dropped to a "1" in May 2019, CreditRiskMonitor subscribers were aware of the evolving risks and would be taking action.

Under the Hood

McDermott International had negative net income and cash flow for a year prior to its January filing. Interest coverage was poor, with the energy services company failing to cover its interest expenses for four consecutive quarters before its eventual bankruptcy. It had negative working capital, and key liquidity ratios were weak due to accumulated billings and the need to tap a revolving credit facility. Tangible net worth was negative for more than a year. In addition, return on equity and return on tangible assets were negative for 12 months prior to its bankruptcy.

If you compared McDermott International to its peers, it ranked in the bottom quartile on many of the most important liquidity and performance metrics. All of these high-risk metrics were at the fingertips of CreditRiskMonitor subscribers, with the ability to export into an easy-to-comprehend report. That report needed to be leveraged to support credit decisions, namely to upper management or sales teams.

Another notable warning sign came when, at the end of Q3 2019, the company classified all of its debt as short term. In the MD&A of that financial report, the company warned that there was substantial doubt about its ability to remain a going concern because it was at risk of tripping its debt covenants. Subscribers can easily access the MD&A section of SEC reports through the CreditRiskMonitor service. McDermott International had been providing covenant updates for over a year. These periodic reviews would have shown it was marginally within compliance of its covenants, including its leverage and fixed charge ratio, before its substantial doubt warning was provided. These red flags highlight the importance of regularly reviewing these quarterly disclosures.

These were not the only signs of trouble, noting that McDermott International also hired turnaround advisors and its CFO jumped ship. CreditRiskMonitor subscribers were kept up to date by receiving important news alerts as they occurred – and as it turned out, things did not get any better as 2019 turned into 2020.

Remember that CreditRiskMonitor subscribers were ahead of the curve here. The first warning was the FRISK® score, yet it most certainly was not the last sign of trouble as McDermott International descended into bankruptcy with outstanding liabilities of approximately $10 billion USD.

Bottom Line

The 96%-accurate FRISK® score, detailed financial analysis, and access to MD&A reports will help you make tough, but necessary business decisions and provide the necessary support to back up your determinations when challenged. CreditRiskMonitor’s tools will help you keep ahead of large public company bankruptcy risks, including those like McDermott International. Call us today to see how you can put our service to work for you.