The FRISK® score enables procurement and supply chain professionals to quickly and efficiently monitor the financial risk of their suppliers, vendors, and third parties. The FRISK® score is particularly useful for subscribers during onboarding RFP processes and for monitoring of existing relationships.

Vendors and suppliers that experience prolonged financial stress often have limited cash and deal with tighter budgets, which can restrict reinvestment into operations, e.g. engineering and tooling, R&D, labor, and fixed assets. Overly distressed suppliers are prone to produce the following outcomes:

The FRISK® score evaluates financial stress and bankruptcy risk for more than 57,000 businesses worldwide, totaling $69.3 trillion in corporate revenue compared to the global GDP of $85.9 trillion. Since public companies comprise the vast majority of purchase and sale transactions, the 96%-accurate FRISK® score will conveniently track your most important counterparties, whether that’s based upon criticality, highest spend, sole-source, or other relevant metrics.

Making the Right Decisions

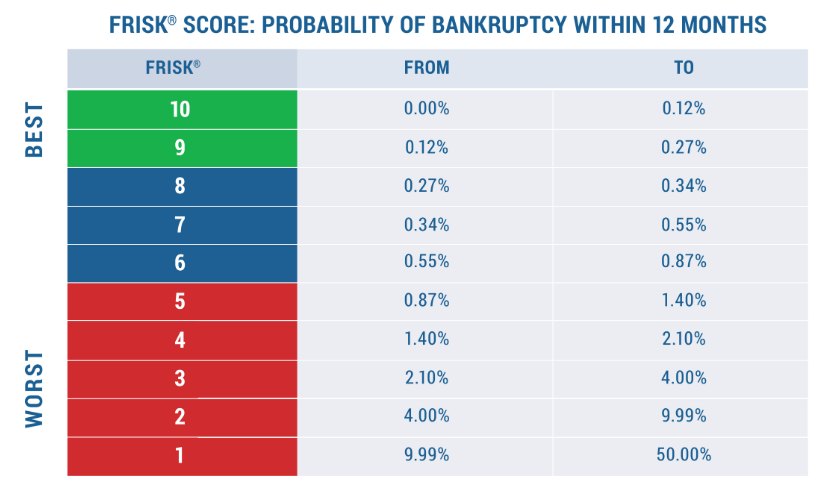

The daily-updated FRISK® score identifies financial stress promptly and alerts subscribers of risk changes. For context, the model is based on a "1" (highest risk)-to-"10" (lowest risk) scale, with anything in the bottom half of that range falling into the high-risk FRISK® score “red zone,” which indicates financial stress.

Risk scoring models developed by competitors such as RapidRatings or Dun & Bradstreet either rely exclusively upon information sources that are only released periodically, like financials, or that can be misleading, such as payment history. However, the AI-driven FRISK® score leverages four distinct data components, including stock market performance, bond agency ratings (from Moody’s, Fitch, and DBRS Morningstar), financial statement ratios, and subscriber crowdsourcing research patterns, all back-tested using nearly two decades of data. Combining these components in a non-linear fashion produces a better, more accurate, and timely risk assessment than any other analytic on the market.

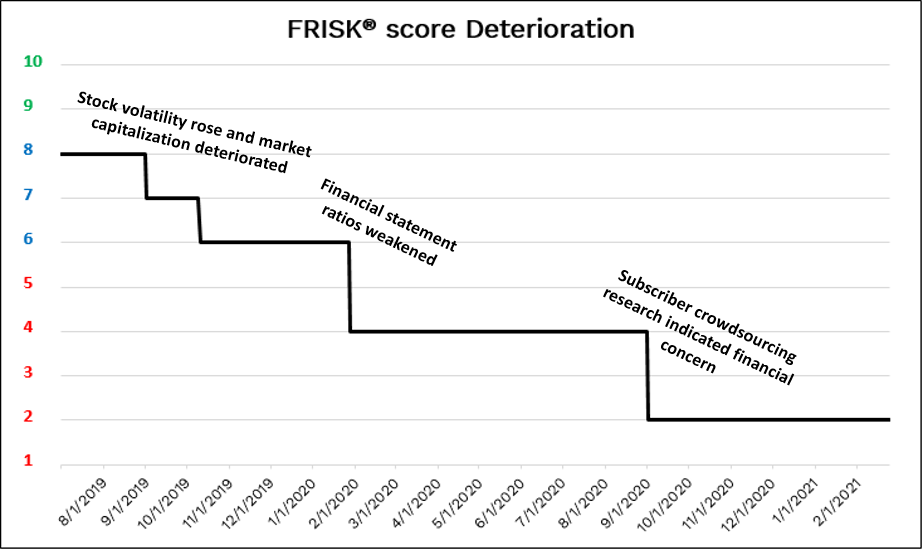

In the following examples, we demonstrate how the FRISK® score trends can change and their implications.

The supplier example below – Company “A” – had previously exhibited financial health on par with an average public company, yet experienced multiple FRISK® score downgrades as a result of deteriorating stock performance, subscriber crowdsourcing concerns, and weakening financial statement trends.

Thus, from a FRISK® score of “8,” indicating strong health, it dropped into the red zone in roughly six months and then all the way down to a “2” inside of one calendar year. We’ve seen similar trends with hundreds of public companies during this COVID-19 pandemic – waiting for a company’s next financial report to assess their risk level could leave you with less time to make important supply chain decisions. Every procurement professional would benefit greatly by having a daily read on the bankruptcy risk potential of public companies in their portfolio.

Despite the narrative that stock market performance and subscriber crowdsourcing serve as leading indicators, crowdsourcing is more effective at identifying higher risk cohorts rather than leading on the deterioration in financial health. On balance, trade credit represents about 25% of all loans to corporations. When a company gets into trouble, credit managers of its suppliers can become concerned enough to reduce or eliminate trade credit extensions which force the company to find alternative sources of working capital, which will be more expensive or perhaps even unavailable. Crowdsourcing of aggregated risk professionals is THE CRITICAL FACTOR that can foretell the tipping point when a distressed corporation is about to file for bankruptcy. CFOs at distressed corporations understand this fact, and therefore manage payment patterns in hopes of shielding their trade credit (i.e. working capital) from being reduced or cut off.

Once more, crowdsourcing patterns help supply chain professionals quickly identify financially distressed counterparties – as an added bonus, a CreditRiskMonitor subscriber also gains a big-time competitive advantage with the FRISK® score’s daily updating components since they provide a read on financial health before financial results are released to the general public. Specifically, the FRISK® score gives subscribers more time in determining which counterparties are distressed to form contingency planning and actions, such as:

- opening discussions with the supplier

- addressing crisis scenarios, such as potential production shutdowns or shortages

- purchasing disruption insurance, and

- identifying and sourcing from alternative vendors

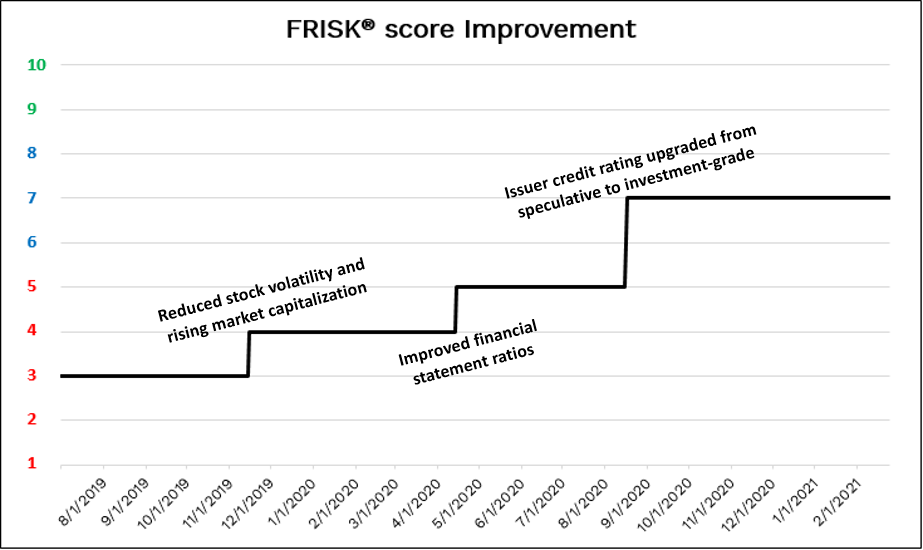

In the next example – Company “B” – shows a previously distressed supplier exhibit gradual improvements in its FRISK® score as a result of positive changes in its stock market performance, financials, and bond agency ratings. Effectively, sustained improvement into the FRISK® blue/green zone indicates stronger financial health and a reduced need for in-depth maintenance reviews.

Additionally, the more sensitive, daily-updated components of the FRISK® score (stock performance and crowdsourcing) often provide an indication of improvement before the more stable data factors, like financials and bond rating updates. Financially healthy suppliers are more reliable for supply chains, particularly during times of economic crisis. Not only will subscribers have peace-of-mind about a supplier’s financial health, but such durability also can lead to other positive supply chain outcomes, such as larger inventory stocks, faster production lead-times, better product quality, etc.

Bottom Line

The FRISK® score is the first-step warning for supply chain professionals to identify financially distressed counterparties, always led by a downgrade into the high-risk red zone. Conversely, improving FRISK® score trends are viewed constructively and give supply chain professionals more confidence in the financial health of their counterparties. The change in score will always be derived from high-quality data sources, including stock performance activity, bond agency ratings, financial statement ratios, and/or subscriber crowdsourcing. By working with financially-strong counterparties, supply chains are undoubtedly more resilient and will help your company maximize growth and profitability. Contact CreditRiskMonitor to learn more about the FRISK® score and how it will enhance your current supplier review process.