CreditRiskMonitor recently debuted its new PAYCE® score, a highly accurate measure of bankruptcy risk when no financial statements are available for private companies.

Resources

Stay Ahead With In-Depth Analytics on Public And Private Companies

The automotive industry faces financial distress, with rising consumer auto loan defaults, supplier bankruptcies, and widespread high-risk conditions. Recent PAYCE® Score data from SupplyChainMonitor™ revealed four private company bankruptcies and identified over 600 U.S. automotive firms in High Risk status. Sourcing professionals can map suppliers, monitor financial health, and receive early alerts on critical disruptions - such as the Novelis plant fire and financial strain at HP Pelzer and Superior Industries.

First Brands Group, a large privately-held auto parts manufacturer, filed for Chapter 11 bankruptcy protection. Our AI-driven PAYCE® Score warned of elevated bankruptcy risk for over a year, whereas the Payment Behavior Score continuously signaled prompt payments.

CreditRiskMonitor's PAYCE® score is providing advanced warning on some high-profile private company bankruptcies already in 2023, with Simmons Bedding Company at the top of the list.

In September, Tricolor Auto Group, a privately-held auto dealer and subprime lender, filed for Chapter 7 bankruptcy liquidation. Our 80%-accurate PAYCE® Score warned of elevated bankruptcy risk for 12 consecutive months, enabling clients to identify and mitigate risk exposure. Learn how our AI-driven financial risk analytics provide clear, actionable insights every day.

Powered by crowdsourcing and deep neural network technology, CreditRiskMonitor® uses two proprietary scores – FRISK® and PAYCE® – to more accurately predict financial risk at public and private companies, respectively.

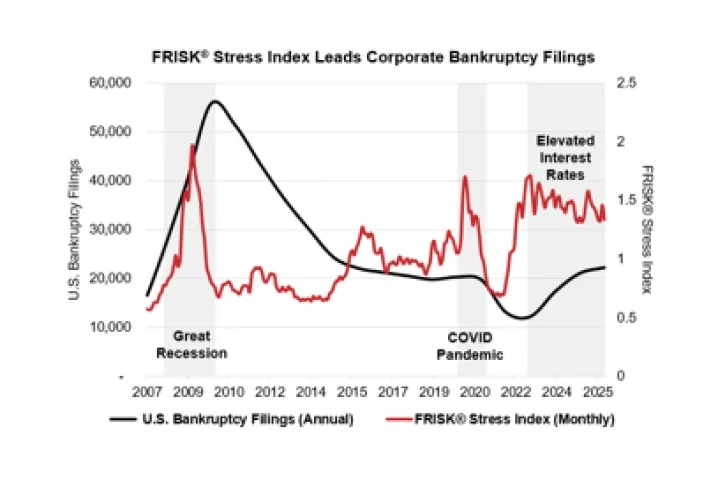

In 2025, U.S. corporate bankruptcies increased for the third consecutive year. Total Chapter 11 and Chapter 7 bankruptcies climbed above 22,000, about 18% higher than the 10-year average of 18,700. Trailing 12-month Q3 2025 bankruptcy filings also reached a 11-year high, according to U.S. Courts data.

CreditRiskMonitor.com, Inc. reported operating revenues of $5.1 million, an increase of approximately $85 thousand or 2%, for the third quarter of fiscal 2025 compared to the same period of fiscal 2024.

CreditRiskMonitor reported operating revenues of $4.55 million, an increase of 5%, for the three months ended Sept. 30, 2022, as compared to the third quarter of fiscal 2021.