CreditRiskMonitor® reported operating revenues of $4.7 million, an increase of approximately $232 thousand or 5%, for the second quarter of fiscal 2023 compared to the same period of fiscal 2022.

Resources

Stay Ahead With In-Depth Analytics on Public And Private Companies

CreditRiskMonitor reported operating revenues of $4.8 million, an increase of approximately $245 thousand or 5%, for the third quarter of fiscal 2023 compared to the same period of fiscal 2022.

CreditRiskMonitor.com, Inc. is pleased to announce that its SupplyChainMonitor™ solution has been recognized once again as a top procurement technology – now in the Spend Matters Fall 2025 SolutionMap.

Make sure you have a way to monitor financial risk in public companies - if you aren't proactive, you may be facing trouble.

Bankruptcy filings are dramatically increasing in 2023; several large Chapter 11s have been accurately predicted already with the aid of our exclusive crowdsourcing data input, made available only to CreditRiskMonitor subscribers.

A dormant debt powder keg ignited in 2023; as bankruptcies continue to explode in 2024, risk professionals must set into motion a multi-faceted approach to financial risk evaluation.

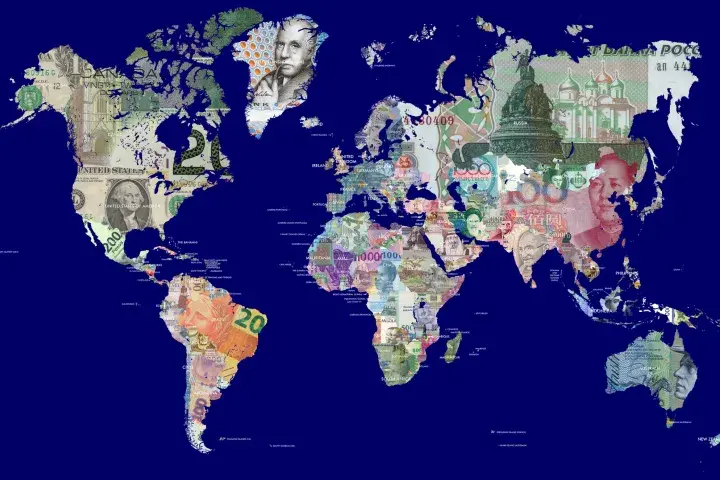

Supplier financial risk in China calls for increased scrutiny. Now is the time to proactively leverage tools like the FRISK® score to conduct objective audits of your prospective and existing suppliers as supply chains restructure.

CreditRiskMonitor today announced that its Board of Directors has appointed Jennifer Gerold as Chief Financial Officer and David Reiner as Chief Accounting Officer, effective May 23, 2024.