The media and financial institutions, including the Federal Reserve, underreport the proliferation of zombie firms, a frightening reality you must not ignore. Learn how you can use the FRISK® score and other CreditRiskMonitor report features to protect your company from bankruptcy-prone zombies.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

You may have heard: the global supply chain is broken. Shipping delays and congested seaports have tripled container freight rates worldwide. We take a look at retail trade businesses with the highest risk potential.

Public and private companies need to be proactively evaluated in distinct, different ways by risk management professionals - fortunately, with the FRISK® score and PAYCE® score, CreditRiskMonitor has world-class solutions for both subportfolios.

CreditRiskMonitor® offers up five quick and important facts that you needed to know about now-bankrupt Rite Aid Corporation to have made a more solid business evaluation – or, more advisable, an alteration of credit extension or a pivot to a peer.

Retailers left and right exited stage left and into bankruptcy this summer. CreditRiskMonitor has the read on a few potential industry giants who might not survive to see 2021.

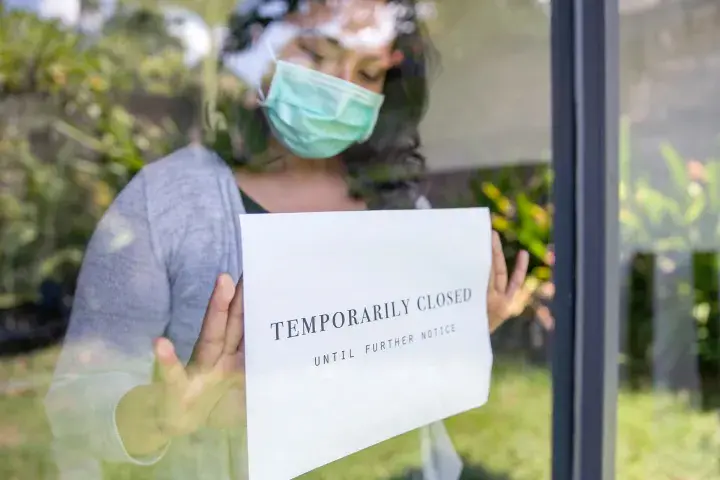

In a pandemic period when major public company bankruptcies are hitting hard daily, reliance on payment performance and/or financial statement analysis provides a whole new slew of dangers.

Deep cracks are surfacing in global corporate debt markets. The timing of corporate bankruptcies is always difficult to predict, yet FRISK® score trends show that the odds of a bankruptcy wave have measurably increased.