The COVID-19 pandemic spurred on airline corporate failures the world over. Some of the biggest names in commercial aviation, including American Airlines and Air France KLM, were choked by travel decline and have been forced to seek creditor and/or government help to continue to operate. CreditRiskMonitor subscribers, in turn, must continue to monitor high-risk airlines even as the industry recovers to reduce potential write-downs and safeguard profitability. More than one full year into restrictive stay-at-home orders across the globe and with vaccinations being administered slowly, there are no guarantees that air travel will experience a full rebound anytime soon.

In this feature, we will examine how airline counterparties can leverage individual company FRISK® scores, bond agency ratings, detailed financial analysis, irreplaceable MD&A disclosures, and timely news alerts to enhance their existing risk management processes.

Monitoring Your Portfolio

In the past 12 months, many airlines failed as a sudden loss of customer traffic resulted in massive cash burns. Others have managed to avoid restructuring but continue to struggle. Both our account representatives and our clients team up early in CreditRiskMonitor subscriber onboarding to create detail-rich portfolios to stratify the risk of the client’s counterparties, which include customers, suppliers, partners, and competitors.

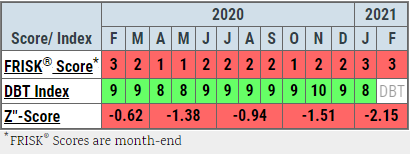

In this case, observe the hypothetical portfolio of customer airlines and their respective FRISK® scores below. The FRISK® score provides a daily update of a particular company’s risk of bankruptcy over the next 12 month period, measured using a scale of “1” (highest risk)-to-“10” (lowest risk) with anything equal to or less than “5” falling into the high-risk “red zone.” The FRISK® score provides a first-step warning signal to identify bankruptcy risk. Among the largest airlines worldwide, observe those trending in the red zone:

Subscribers can further observe that certain companies exhibit improving FRISK® score trends signaled by a move out of the red zone. Companies can rise and fall in the red zone, but exiting this range of the FRISK® score indicates notable and sustained financial recovery, which should restore counterparty confidence. Effectively, subscribers can see they need to spend their time assessing distressed counterparties. It only takes one bankruptcy filing to cause major problems, so don’t waste effort on companies that are strong or strengthening significantly. In the past year alone, 11 large public airlines have exposed counterparties to financial losses and supply chain disruptions. For a deeper dive, see our Bankruptcy Case Studies on Virgin Australia Holdings Ltd. and Grupo Aeromexico SAB de CV.

Analyzing Distressed Companies

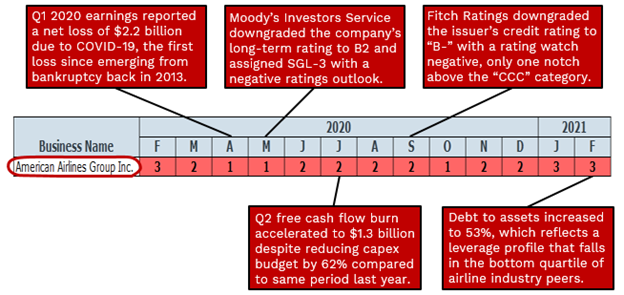

After reviewing a portfolio, risk professionals should dig into the commercial credit reports for distressed counterparties, particularly those that are trending deep within the FRISK® score red zone. American Airlines Group Inc., for instance, remains in the lower rungs of the FRISK® score range. The FRISK® score considers four data components in its calculation methodology including stock market performance, financial statement ratios (similar to the Altman Z’’-Score), bond agency ratings from Moody’s, Fitch and DBRS Morningstar, and finally, subscriber crowdsourcing. Together, these components provide a reading that indicates major financial stress at American Airlines.

Now, take a look at the contrast of the FRISK® score with the DBT Index (similar to Dun & Bradstreet’s PAYDEX® score), which is predicated upon timely payment performance:

Nearly all public companies will exhibit strong payment behavior up to the final days before bankruptcy. Even while distressed, most public companies have access to capital markets to create the perception of financial stability. For public companies, a bill paid on time today is not predictive for what happens tomorrow.

American Airlines’ financials revealed net losses of nearly $9 billion, an accrued net debt position of $33.5 billion, and an equity deficit approaching $7 billion in FY21. Its MD&A disclosed that liquidity support has come from the U.S. government CARES Act along with incremental debt and equity issuances. Additional disclosures indicate that American Airlines must maintain compliance with multiple covenants, including a $2 billion liquidity test:

“...maintain an aggregate of at least $2.0 billion of unrestricted cash and cash equivalents and amounts available to be drawn under revolving credit facilities, and our Treasury Term Loan Facility contains a debt service coverage ratio, pursuant to which failure to comply with a certain threshold may result in mandatory prepayment of the Treasury Term Loan Facility.”

Throughout the COVID-19 pandemic, subscriber crowdsourcing on American Airlines has fluctuated between neutral and unfavorable, reflecting “concern” about the company’s financial condition. This aggregated concern consists of daily updated research patterns, which can involve detailed financial analysis of cash flow and liquidity spreads, which feed directly into the FRISK® score. The bond agencies have maintained highly speculative ratings too, paralleling our subscribers’ concerns.

Ongoing news stories play an important role as well. Certain events, such as executive turnover, layoffs, asset sales, or covenant amendments, in combination with financial distress, should be promptly reviewed. American Airlines, for example, announced that it may need to commit to as many as 13,000 layoffs to cut costs.

Factoring in all of these information sources helps subscribers quickly evaluate counterparty financial stress and make better business decisions.

Bottom Line

Subscribers should evaluate their CreditRiskMonitor portfolio and individual companies frequently to stay ahead of financial distress and bankruptcy. Despite easy credit conditions, even some of the most renowned public companies globally are hanging on by a proverbial thread. Should economies falter or capital markets seize up, risk professionals will be standing in front of another wave of bankruptcy filings. The troubled airline industry is only one example of the broader challenges businesses face today. Contact CreditRiskMonitor to see how the service can be used to proactively manage risk and achieve profitable growth.