Inflation in the U.S. has risen to 7.5% as of January 2022, its highest level in nearly 40 years. Financially strong companies can absorb inflation, accepting lower margins while they work to pass rising expenses on to customers. Yet overleveraged, weak companies – notably those in the high-risk FRISK® score "red zone," will not have nearly as much leeway. With sustained inflation seemingly on tap for the next several months if not longer, bankruptcy risk is surging globally. CreditRiskMonitor strongly advises that risk professionals closely review any counterparty with a red FRISK® score daily.

Where to Look

Inflation is a normal part of business life, with cost-cutting and price increases traditionally considered the means to combat it. Inflation in 2021-22, however, has come at a rapid clip, thanks to fiscal largess related to the coronavirus pandemic and accommodating interest rates from central banks globally. The purpose of these moves was to support economic growth. They achieved that goal.

Economies around the world, it seems, were a little *too* stimulated. Additionally, supply chain bottlenecks have added fuel to the inflation fire. While central banks are starting to hike rates, with the U.S. Federal Reserve indicating it will do so soon, some damage has already surfaced. Companies that were already at material risk of bankruptcy, indicated by low FRISK® scores, will need to pull added levers to try and adequately service balance sheets loaded with debt.

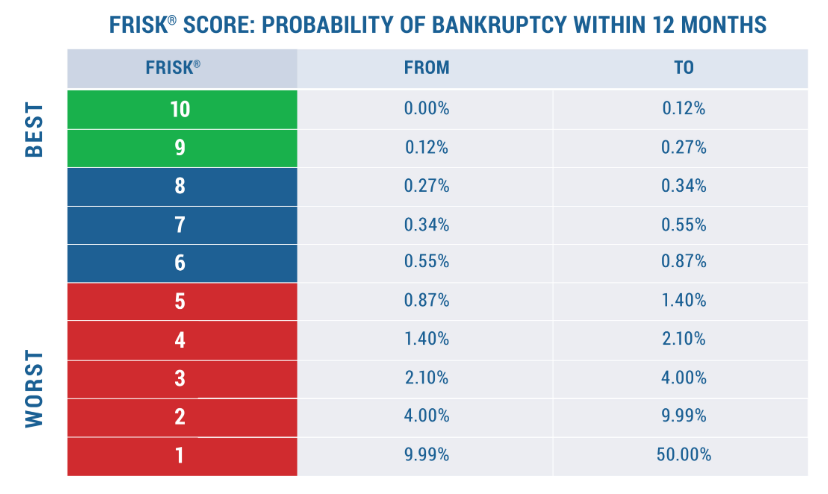

The FRISK® score incorporates financial statement ratios, stock market performance, bond agency ratings from Moody’s, Fitch, and DBRS Morningstar, and the researched click pattern behavior of our subscriber base. This combination of data allows the score to correctly identify 96%+ of all publicly traded companies that eventually go bankrupt with enough lead time to act. The nonlinear, composite nature of the FRISK® score allows its accuracy rate to surpass that of any and all single-component models using the individual components listed above. A score of "5" or below on the "1" (highest risk)-to-"10" (lowest risk) score, which falls into the worrying red zone, indicates that financial counterparties need to pay close attention to the risks they face. A rapid rise in inflation only makes the situation worse.

Margin Pressures

Team, Inc. has a FRISK® score of "1," which indicates bankruptcy risk that is 10-to-50x that of the average publicly-traded company. Management highlighted the massive price increases impacting the business in its Q3 2021 earnings conference call:

"Gross margin was 24.5%, down from 29.1% in the prior-year quarter. Gaining upward traction on gross margin remains a challenge. During the quarter, Team faced underlying inflationary pressures in our supply chain, including raw materials, labor, equipment, logistics, and travel, as well as absorbing the higher expenses associated from the elimination of the temporary cost actions that were put in place in late March of 2020. We also incurred higher-than-normal costs, as we ramped up our investment in technician training and certifications to prepare for the fall turnaround season and an active 2022."

The company has posted losses in each of the last three quarters, had negative free cash flow in two of those quarters, and didn't cover interest expense in four of the last five quarters. With a heavily leveraged balance sheet, the company doesn't have much time to push cost increases through to customers.

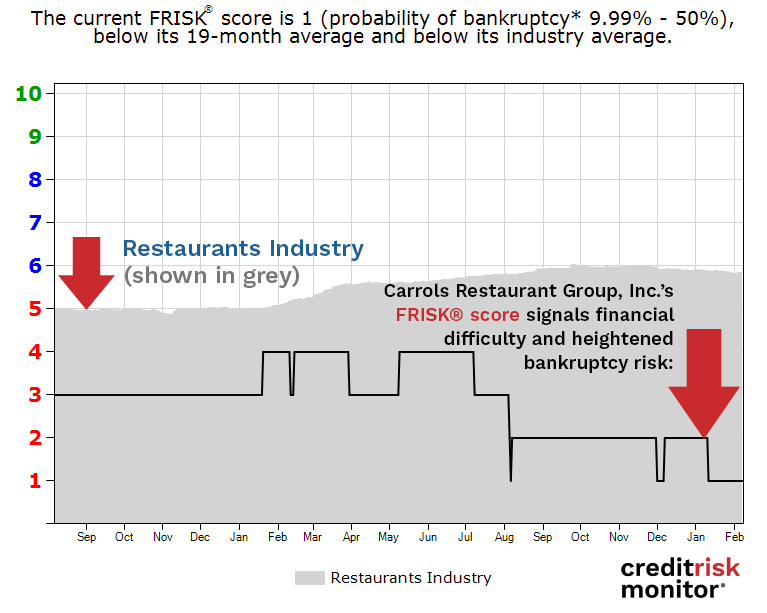

Carrols Restaurant Group, Inc. reported a compression in trailing 12-month gross margins from 38.3% to 37.3%. While that line item is not as serious, wage inflation in the third quarter was 13% or so, a figure that the company tagged as "unprecedented." And the issue isn't expected to go away anytime soon, with 97% of CFOs in a recent Deloitte survey looking for labor costs to increase substantially in 2022. Of course, the company is also looking at commodity cost increases, too. Commenting on the severity of the issue, the company noted:

"The question (sic) we are struggling to answer are: 'What portion of the higher labor costs are transitory' and 'Will commodity costs follow their traditional cyclical patterns and revert to the mean?' We don't have these answers, but we do know that the inflationary cost pressures we experienced during the third quarter were not expected to the degree that they impacted our industry."

Crowdsourced research patterns of CreditRiskMonitor subscribers, which encompasses suppliers to the business, recently began signaling concern and negatively impacted the FRISK® score to a "1." Carrols Restaurant Group, Inc. has also lost money for four consecutive quarters and had its debt to EBITDA ratio spiral to nearly 8x in Q3 2021. If the company can't get a handle on rising costs, deeper financial trouble will be around the corner.

Bottom Line

Team, Inc., and Carrols Restaurant Group, Inc., are but two company examples with troublingly low FRISK® scores that are struggling to deal with inflation. Most companies will muddle through this period with a temporary hit to margins, but some will not manage that feat due to a lack of pricing power and heavy debt burdens. Contact CreditRiskMonitor today so we can help you figure out which of your counterparties you need to focus on.