WeWork Inc. fell from an IPO valuation of $47 billion in 2019 to a market capitalization of $5 billion. In February, the company announced a partnership with UpFlex to establish a global combined network of 5,500 locations, up from around 700, to become one of the largest shared workspace operators. However, the 96%-accurate FRISK® score currently indicates severe financial stress with its crowdsourced sentiment component, a daily-updating and independently predictive corporate bankruptcy signal derived from the aggregate usage behavior of CreditRiskMonitor’s subscribers, flashing concern. We dig into the distressed position of this real estate giant.

The FRISK® Score Senses Danger

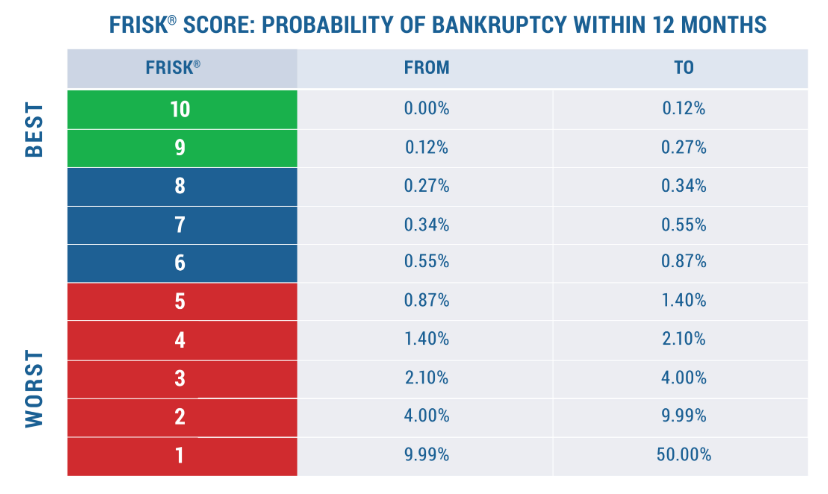

The FRISK® score incorporates financial statement ratios, stock market performance, bond agency ratings from Moody’s, Fitch, and DBRS Morningstar, and the aggregate risk sentiment of our subscriber base. This combination of data allows the score to capture a baseline of 96% of all publicly traded companies that eventually go bankrupt within its high-risk category at least 3 months before they file. A score of "5" or below on the "1" (highest risk)-to-"10" (lowest risk) score, which we call the "red zone," makes up this high-risk group. The nonlinear, composite nature of the FRISK® score is the source of its superior accuracy relative to single-component class models such as trade payment-based and financial ratio-based frameworks.

WeWork Inc.’s FRISK® score currently trends at the riskiest category of “1,” indicating a 10-to-50x higher risk of bankruptcy than the average public company. This high-risk assessment derives from multiple factors, including:

- Elevated stock price volatility and total liabilities to market capitalization ratio of 5x.

- Negative TTM EBIT, poor equity to liabilities, negative working capital, and an accumulated deficit.

- Fitch’s credit rating of “CCC+”, indicates substantial default risk.

- Real-time subscriber crowdsourced sentiment indicating elevated levels of concern

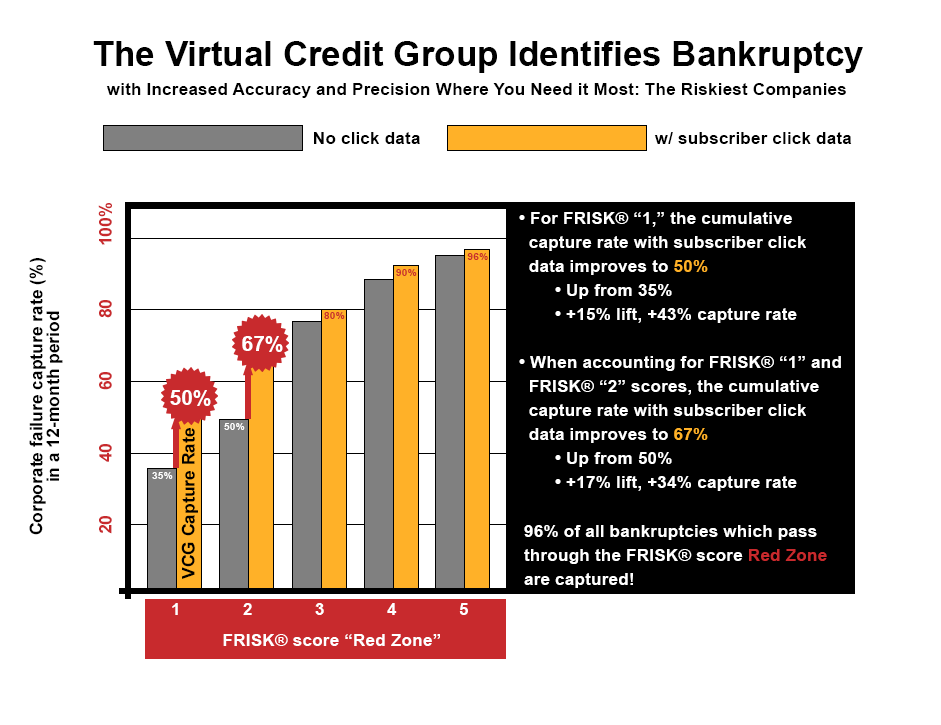

CreditRiskMonitor's service is delivered via a highly structured web platform, which has enabled us to track the aggregate usage behavior of subscribers as they perform risk research on companies in real-time for over a decade. This influential group of risk professionals includes users from nearly 40% of the Fortune 1000 plus over a thousand other large businesses worldwide. Using this data, CreditRiskMonitor was able to develop a proprietary aggregate sentiment model that updates daily and is independently predictive of corporate bankruptcy risk. This model specifically identifies the shift in aggregate sentiment among the issuers of trade credit and therefore assists in the monitoring of the most critical situations when trade credit-based working capital liquidity can dry up. Here we can see how subscriber sentiment, which is like a "virtual credit group," enhances the accuracy of the FRISK® score:

In recent months, subscriber crowdsourcing patterns negatively influenced WeWork Inc.’s FRISK® score to a “1,” which represents the highest bankruptcy risk classification. Here is what risk professionals are looking at and why WeWork Inc. is so troubling.

Dwindling Cash Liquidity

WeWork Inc.’s Q4 2021 operating performance showed that TTM adjusted EBITDA losses were $1.5 billion, TTM net losses were $4.6 billion, and its free cash flow burn was $2.2 billion. When looking at operating cash flow, which excludes capital expenditures, the annualized burn rate was about $1.9 billion. WeWork Inc. projects that FY22 will be a turnaround year. According to the company’s October 2021 presentation, the company estimated that 2022 revenue would reach $4.35 billion versus pre-COVID 2019 revenue of $3.23 billion – a challenging feat given work-from-home trends and competition from office landlords and other shared workspace operators. WeWork Inc. also estimated that adjusted EBITDA would approach $243 million and $1.26 billion for FY22 and FY23, respectively. The company's FY21 interest expense was about $454 million, indicating that break-even profitability would still be at least a year away.

Liquidity remains weak with the company's Q4 2021 working capital still in a deficit. When adjusting for current operating lease liabilities and deferred revenue, the company’s working capital stands at approximately $351 million, however, most of this balance was shored up through cash proceeds received from unsecured related-party debt.

Compared against its Real Estate (SIC 65) industry peers, WeWork Inc. ranks in the bottom quartile of liquidity ratios and leverage ratios. For example, its Q4 current ratio was only 0.69 compared to the industry median of 1.52 and TTM EBITDA to total debt was negative versus positive for industry peers.

Last December, financial backer SoftBank sold $550 million of its bonds in WeWork Inc. and by February, Softbank’s Chief Operating Officer, Marcelo Claure, resigned effective immediately. Mr. Claure was also Executive Chairman on WeWork Inc.’s board of directors and exited. Executive departures combined with a red zone FRISK® score is a common signal before company bankruptcy filings.

Fitch Ratings' research note described the company’s liquidity risk in the event office occupancy trends remains depressed:

“WeWork's financial policy while supportive of providing needed liquidity may not be sufficient in the medium term to protect creditors. Fitch does not expect under its base case that WeWork will need to draw on SoftBank's senior secured facility although its existence along with the funds raised from outside investors supports a meaningful liquidity buffer. However, in a more elongated depressed office demand environment, Fitch does not believe WeWork's available liquidity is sufficient.”

The senior unsecured credit rating was affirmed at “CCC-“, which reflects heightened default risk and limited recovery prospects relative to secured positions. Based on March prices, WeWork Inc.’s unsecured bonds were selling at $0.86 and $0.78 on the dollar, or distressed yields ranging from 13.2% to 13.3%.

WeWork Inc. carries substantial outstanding liabilities of approximately $22 billion.

Bottom Line

WeWork Inc. continues to expand its network and carries some untapped funding sources, but has not proved that it can control its cash burn. Crowdsourced subscriber sentiment is signaling to the FRISK® score that bankruptcy could be in the cards by next year. As of Q4 2021, accounts payable and accrued expenses totaled $1.5 billion, which would compete for repayment with unsecured creditors who tally well into the billions in a restructuring scenario. Contact CreditRiskMonitor to see how we can help you stay ahead of the 2022 bankruptcy spike.