Macroeconomic risks are seemingly out of control in 2022, underpinned by the following events:

- The Russia-Ukraine war and NATO geopolitical tensions have shocked commodity markets

- Inflation and commodity prices, e.g. crude oil, metals, and grain, have approached record highs

- Rising input costs and supply disruptions remain with a new wave of China COVID-19 lockdowns

- Global debt reached a new record of $303 trillion globally

- The University of Michigan stated U.S. consumer sentiment sank to a decade low

- Central banks are tightening monetary policy, leading to weaker credit conditions

The 2/10 Treasury Spread has also contracted significantly in 2022, and a flattening yield curve emerges before every recession. Such an economic backdrop unleashes problems for the corporate sector, especially zombie companies that cannot service their interest payments. In the last four months, high-risk FRISK® scores worldwide increased by 25%, which signals mounting bankruptcy risk. Credit and supply chain professionals should review their portfolios immediately.

Highest-Risk Industries

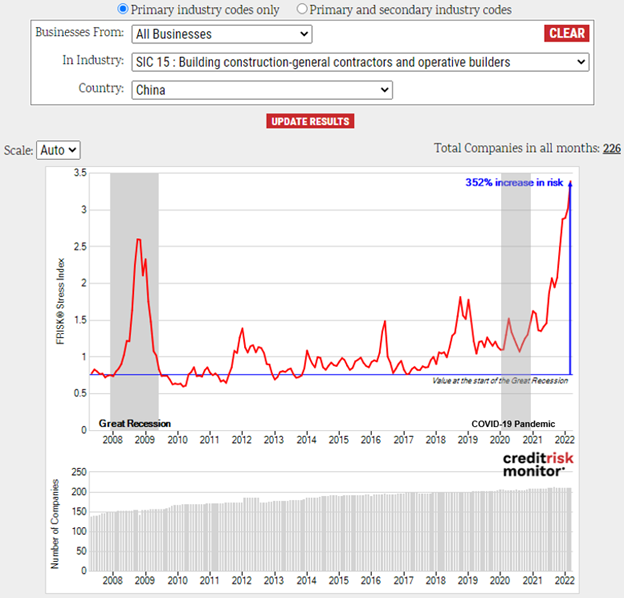

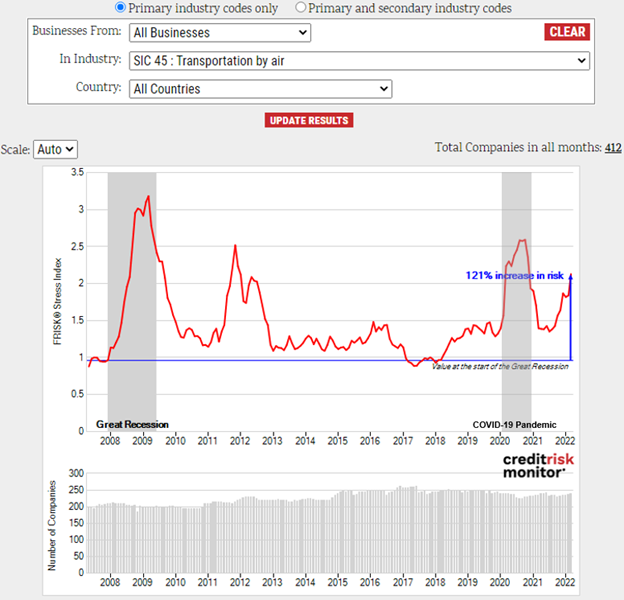

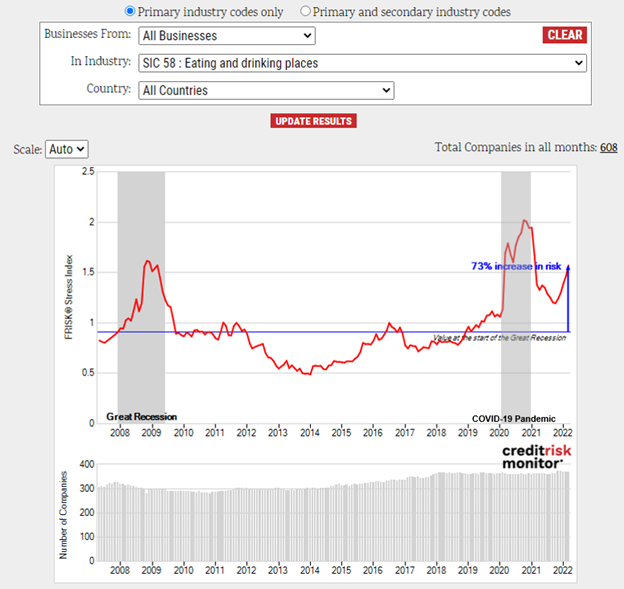

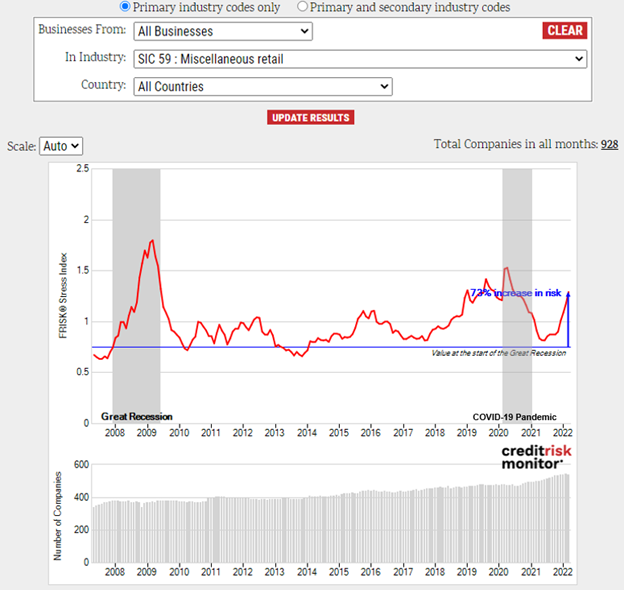

The FRISK® Stress Index is rising for nearly all industries, which reflects higher levels of aggregate bankruptcy risk. In the graphics shown below, we have identified four of the riskiest industries. The FRISK® Stress Index shows the collective probability of failure in a group of companies (such as an industry, country, or portfolio) over the coming 12 months.

Building Construction – General Contractors And Operative Builders (SIC 15)

The residential housing supply in China has reached overcapacity, which has resulted in a complete meltdown of the building construction industry. With more than $1 trillion in corporate liabilities exposed to restructuring risk, even the largest operators are scrambling to survive. China Evergrande Group (FRISK® score of “1”) specifically announced it would submit a restructuring proposal before the end of July.

Transport by Air (SIC 45)

Higher crude oil prices have led to increases in jet fuel costs, especially since many airlines have allowed fuel hedges to roll off, fully exposing their budgets to oil price volatility. For example, American Airlines Group, Inc. (FRISK® score of “2”) disclosed such vulnerability in its Q4 2021 management, discussion, and analysis (MD&A) section:

"As of December 31, 2021, we did not have any fuel hedging contracts outstanding to hedge our fuel consumption. Our current policy is not to enter into transactions to hedge our fuel consumption, although we review that policy from time to time based on market conditions and other factors. As such, and assuming we do not enter into any future transactions to hedge our fuel consumption, we will continue to be fully exposed to fluctuations in fuel prices."

Eating and Drinking Places (SIC 58)

The restaurant industry is impacted by food price inflation as consumers on the margin seek to eat at home rather than dine out. Falling restaurant traffic combined with higher food and labor costs, only partially being offset with price increases, spells trouble for highly leveraged operators.

In this context, Carrols Restaurant Group, Inc. (FRISK® score of “1”) acknowledged such issues within the MD&A of its latest Form 10-K filing:

"In 2021, we have experienced inflationary cost pressures in labor and commodity costs as a result of challenges in the overall labor force impacting our restaurants and our supply chains. The COVID-19 pandemic has increased the difficulty and cost of maintaining adequate staffing levels at our restaurants as well as for businesses in our supply chain that we depend on for commodities. At this point, there is no indication as to when these pressures will abate. We typically attempt to offset the effect of inflation, at least in part, through periodic menu price increases and various cost reduction programs. However, no assurance can be given that we will be able to offset such inflationary cost increases in the future."

Miscellaneous Retail (SIC 59)

Other retailers, in general, continue to struggle with supply chain challenges, incurring the higher costs of goods sold, transportation, and labor expenses. Without pricing power, less efficient retailers are either give up market share or stand to incur operating losses.

A prime example is Party City Holdco, Inc. (FRISK® score of “2”), which stated in its MD&A that supply chain challenges continue to hammer the retail industry:

"The unique supply chain challenges have resulted in limited benefits from existing contract protections, and therefore we believe all retailers continue to be impacted by these increased costs…we have begun to adjust our order timeline throughout the supply chain and continue to find transportation alternatives to mitigate what we expect will be continuing volatility. We also continue to increase capacity in our U.S. manufacturing plants, including Anagram."

Bottom Line

The pandemic swiftly delivered hundreds of bankruptcy filings in 2020. Here in 2022, geopolitical tensions, supply chain challenges, and tightening credit conditions could lead to a similar devastating outcome. Economically sensitive industries are already showing signs of higher bankruptcy risk. Credit and procurement professionals should heed these warnings and review their portfolios for their highest risk counterparties. Contact CreditRiskMonitor today to learn how you can use the FRISK® score to protect your company from the next economic downturn.