The FRISK® score is a game-changing tool that combines several key inputs to assess bankruptcy risk. The first of a five-part look at these inputs, here’s how the stock market plays a role.

Resources

Stay Ahead With In-Depth Analytics on Public And Private Companies

The FRISK® score is a game-changing tool that combines several key inputs to assess bankruptcy risk. Here’s how credit manager crowdsourcing play a role.

Risk professionals like yourself are preparing for another economic downturn and our API will enhance your workflows. This scalable data provides automation for supply chain analysis, reviewing prospective vendors, and RFP processes.

In 2022, end users are leveraging CreditRiskMonitor’s API to improve workflow efficiency, and communicate reliable, reputable data across their entire teams. This scalable data provides automation for company evaluations to improve credit reviews, cash collections, and minimize receivable write-downs.

With inflation at a 40-year high and interest rate hikes beginning to be implemented, more and more overleveraged companies with sinking FRISK® scores are in greater danger of bankruptcy in 2022.

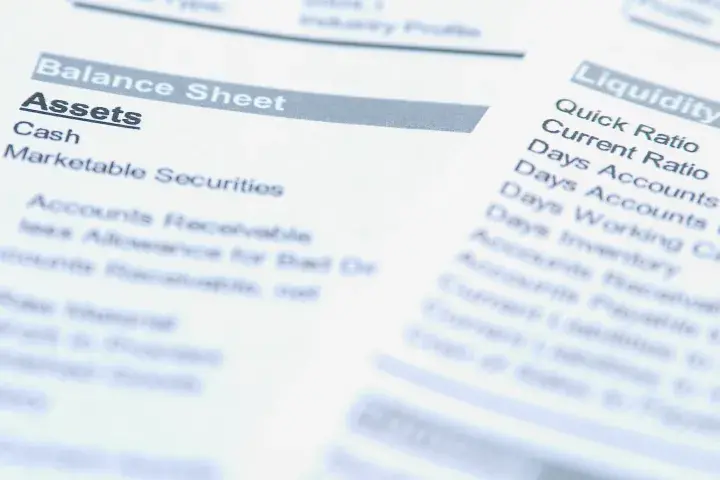

The FRISK® score is a game-changing tool that combines several key inputs to assess bankruptcy risk. Here’s how financial ratios play a role.

Now is the time for anyone who has neglected establishing a strong credit culture to learn how to best sound the alert, arming yourself with CreditRiskMonitor’s offerings.

Avoid the crash: not having a daily risk download like what we provide subscribers with our proprietary FRISK® score, when world events like armed conflict are changing industry every day, is like flying a plane without instruments through a hurricane.

While risk analysis professionals may be tempted to use the statistical FRISK® score as a component within a different model, such as one that is rules-based, doing so may generate suboptimal results.