The new FRISK® Stress Index is a fast, powerful way to see risk levels of industries, countries or your portfolio.

Resources

Stay Ahead With In-Depth Analytics on Public And Private Companies

A recent IMF report has highlighted a surge in instability within nonfinancial corporations. As the potential for mass economic failure mounts, CreditRiskMonitor is providing the daily markers that effectively signal on the counterparties in your portfolio that hold the most extreme bankruptcy risk potential.

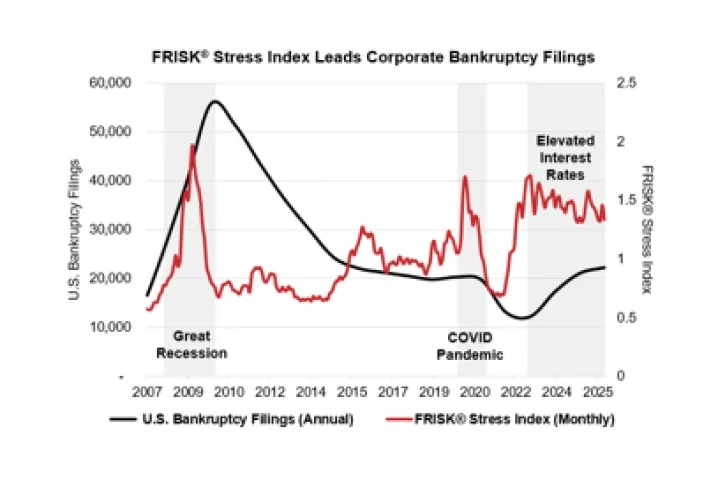

In 2025, U.S. corporate bankruptcies increased for the third consecutive year. Total Chapter 11 and Chapter 7 bankruptcies climbed above 22,000, about 18% higher than the 10-year average of 18,700. Trailing 12-month Q3 2025 bankruptcy filings also reached a 11-year high, according to U.S. Courts data.

Shipping company Rand Logistics, Inc., drowned in a proverbial sea of debt in the months leading up to their January 2018 bankruptcy.

A dormant debt powder keg ignited in 2023; as bankruptcies continue to explode in 2024, risk professionals must set into motion a multi-faceted approach to financial risk evaluation.

Now is the time for anyone who has neglected establishing a strong credit culture to learn how to best sound the alert, arming yourself with CreditRiskMonitor’s offerings.

Chinese property developer defaults have become the norm, with formal bankruptcies now beginning to take shape. Industry giant China Evergrande Group may be among the next to file.

Property development represents about 30% of China’s GDP. Ongoing defaults could eventually convert into bankruptcy filings that would shake up the industry - and subsequently rock markets in the West.

What are the root causes of the failure of risk models to provide adequate warning? After nearly 25 years of company operation and observation, CreditRiskMonitor® has identified four common problems among competing risk models.