In 2022, end users are leveraging CreditRiskMonitor’s API to improve workflow efficiency, and communicate reliable, reputable data across their entire teams. This scalable data provides automation for company evaluations to improve credit reviews, cash collections, and minimize receivable write-downs.

Resources

Stay Ahead With In-Depth Analytics on Public And Private Companies

Now is the time for anyone who has neglected establishing a strong credit culture to learn how to best sound the alert, arming yourself with CreditRiskMonitor’s offerings.

The FRISK® score is a game-changing tool that combines several key inputs to assess bankruptcy risk. Here’s how credit manager crowdsourcing play a role.

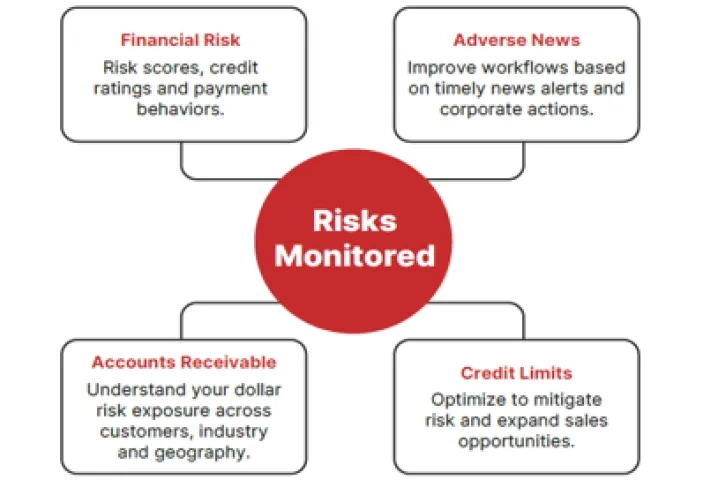

Credit professionals use CreditRiskMonitor®’s Trade Contributor Program to gain quality, real-time insights into their accounts receivable portfolio. We collect in excess of $2 trillion in trade data annually from our trade providers. After processing this data, we work with credit professionals to be more proactive and tactical with their accounts receivable to make healthier business decisions.

In preparation of future bankruptcies, credit professionals are using CreditRiskMonitor’s Credit Limit Ranges solution for automated monitoring on the size of credit lines.

Our bankruptcy case study of FAT Brands, parent company of Johnny Rockets, shows that the FRISK® Score flagged elevated bankruptcy risk more than a year before the filing. The FRISK® Score identified elevated bankruptcy risk 12 months prior to its filing. Most importantly, crowdsourced intelligence triggered a downgrade to a FRISK® Score of "1" using insights from the credit community, including risk professionals from nearly 40% of the Fortune 1000.

CreditRiskMonitor® is a powerful, web-based risk monitoring platform for credit, finance, treasury, and risk management professionals. It continuously tracks the financial health of all your customers and prospective customers, alerting you to emerging risks and bankruptcy threats so you can address them before they impact your accounts receivables and bottom line.

By tracking the behavior of credit managers and other professionals, crowdsourcing becomes the critical advantage that CreditRiskMonitor subscribers gain.

CreditRiskMonitor today announced a new licensing agreement with DBRS, an independent, privately-held, globally recognized credit agency.