Explore how the PAYCE® Score delivers industry-leading financial risk prediction on private companies without financial statements.

Resources

Stay Ahead With In-Depth Analytics on Public And Private Companies

American freight transporter Yellow Corporation has declared bankruptcy after years of financial struggles and growing debt, marking a significant shift for the U.S. transportation industry and shippers nationwide.

The seismic data survey industry appears to be sinking; can Norwegian company PGS ASA stay afloat in 2021 in the midst of an oil price crisis?

China-based property developer Tahoe Group is providing evidence that the real estate bubble has resulted in ballooning inventories and distorted balance sheets, leaving less capitalized peers to struggle in an overly distended industry.

CreditRiskMonitor will be attending the Credit Research Foundation's upcoming March Forum. This forum will deliver a concentrated lineup of sessions designed to help credit, finance, and order-to-cash leaders navigate the operational, economic, and technological shifts shaping 2026. Join us at the event to discuss strategy, best practices, our latest solutions, and more.

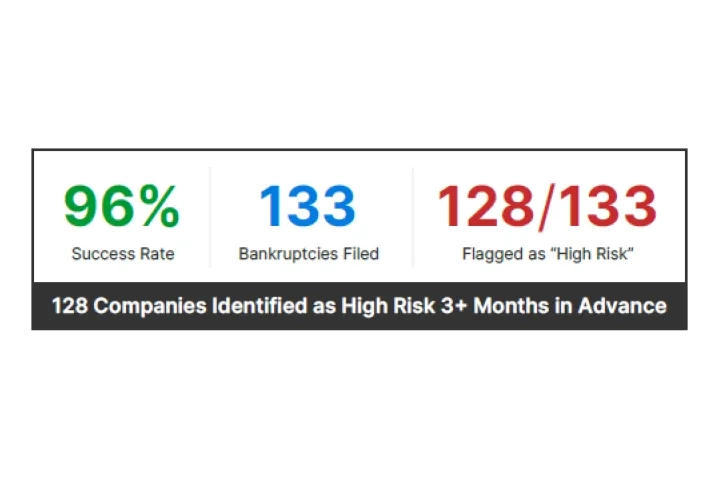

From January through December 2025, the FRISK® Score maintained its 96% success rate in accurately identifying public companies that declared bankruptcy. Of the 133 companies that filed during this period, 128 were flagged as “high risk” at least three months in advance. Explore how the FRISK® Score achieves its industry-leading performance and why nearly 40% of the Fortune 1000 use it in their daily workflows.

Our subscriber survey results show an impressive Net Promoter Score (NPS) of 77, ranking as excellent on a scale from -100 to +100. Discover the ratings from our customers and how we stack up against the broader SaaS industry. Click to learn more!

Get a closer look at how the FRISK® Score delivers industry-leading financial risk prediction. Nearly 40% of the Fortune 1000 and over a thousand other corporations worldwide use this model in their workflows.

Learn how we combine cutting-edge technology with disciplined human oversight to deliver accurate, transparent data. AI and machine learning helps us bolster our industry-leading financial risk models, process financial statements quickly, and provide FAST Ratings at scale. We also adhere to responsible AI practices.