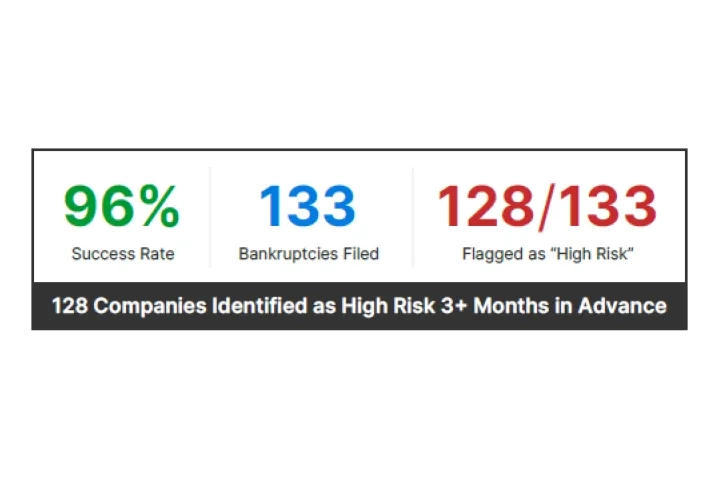

From January through December 2025, the FRISK® Score maintained its 96% success rate in accurately identifying public companies that declared bankruptcy. Of the 133 companies that filed during this period, 128 were flagged as “high risk” at least three months in advance. Explore how the FRISK® Score achieves its industry-leading performance and why nearly 40% of the Fortune 1000 use it in their daily workflows.

Resources

Stay Ahead With In-Depth Analytics on Public And Private Companies

Get a closer look at how the FRISK® Score delivers industry-leading financial risk prediction. Nearly 40% of the Fortune 1000 and over a thousand other corporations worldwide use this model in their workflows.

Read this in-depth white paper to learn more about CreditRiskMonitor's proprietary FRISK® score, how it works and why it's so accurate.

How can we be so sure of the accuracy? We measure it. Download this scorecard to see how the score performed in 2015 & 2016. In short – we predicted 98.6% of U.S. public company bankruptcies at least 90 days in advance.

CreditRiskMonitor delivers a highly accurate gauge on U.S. public company bankruptcy risk. In 2021, out of 13 occurrences of bankruptcy, our proprietary FRISK® score hit on all 13 bankruptcies. That amounts to a perfect 100% rate of success during that time.

CreditRiskMonitor delivers a highly accurate gauge on U.S. public company bankruptcy risk. In 2020, out of 85 occurrences of bankruptcy, our proprietary FRISK® score only missed predicting two bankruptcies. That amounts to a 97% rate of success during that time.

CreditRiskMonitor delivers a highly accurate gauge of U.S. public company bankruptcy risk. During the preceding three calendar years from 2020 to 2022, out of 352 occurrences of bankruptcy, our proprietary FRISK® score only missed predicting 17 bankruptcies. That amounts to a 96% rate of success during that time.

Over the last two completed calendar years, CreditRiskMonitor's FRISK® score was able to predict U.S. public company bankruptcy at a near 98% rate of success.