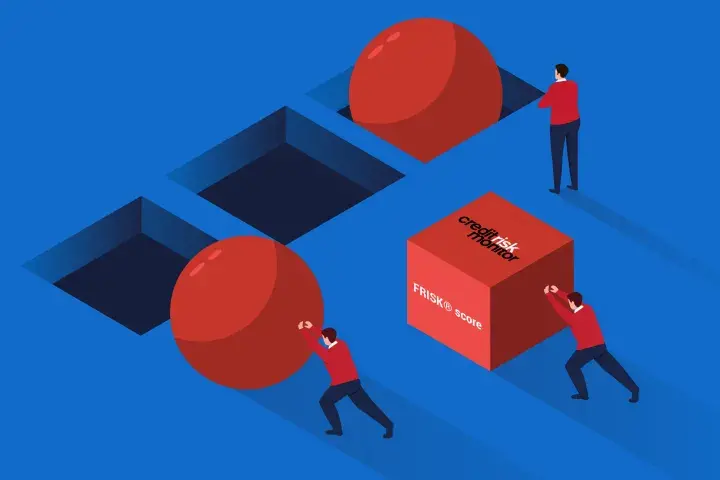

The media and financial institutions, including the Federal Reserve, underreport the proliferation of zombie firms, a frightening reality you must not ignore. Learn how you can use the FRISK® score and other CreditRiskMonitor report features to protect your company from bankruptcy-prone zombies.